Jennifer Robson and Michael Smart

The Canada Recovery Hiring Program (CRHP) is a 50 per cent wage subsidy for employers and the new centrepiece of federal job support programs. CRHP is targeted at employers who hire new workers or expand hours worked, which should make it more cost-effective than the previous federal wage subsidy. But the restriction of the program to private corporations and the lack of guardrails to prevent abuse could be a problem. We propose reforms that would make the program better-targeted at increasing employment and raising workers’ pay.

Observers were not particularly surprised in late October when some of the federal emergency labour market support programs for businesses were extended yet again. Arguably, the new programs are better targeted than the expiring Canada Emergency Wage Subsidy (CEWS) – aimed at the hardest-hit industrial sectors and businesses, and more generally at encouraging new hires instead of subsidizing existing jobs. But it’s still not clear the programs will deliver value-for-money, and there are new potential problems as well.

The Canada Recovery Hiring Program (CRHP) is the successor to CEWS and the new centrepiece of federal job supports. Announced in the federal budget of 2021 and in place since June 2021, it pays eligible businesses that increase their payroll expenditures above baseline levels achieved earlier in the pandemic – in contrast to CEWS which subsidized all eligible jobs, whether this amounted to an increase in employment or not. Unlike CEWS, the CRHP is also restricted to only non-profits, small co-operatives and Canadian-controlled private corporations (CCPCs).

CRHP was designed to be temporary, with a subsidy rate that has decreased from June to October. However, last month’s announcement said it would be enriched back to 50 per cent (from the current 20 per cent) and extended to May 7, 2022.

Problems with CEWS

The Canada Emergency Wage Subsidy has been a lifeline to some hard-hit businesses, and a source of profit to many more. Business and labour leaders alike have been vocal in their support for the program, which has cost $96 billion so far.

But what’s good for business and good for organized labour is not always what’s best for the country. CEWS has been critiqued for its high cost to the federal government, relative to the small number of jobs it has likely created or saved during the pandemic. Under various iterations, the program was available with subsidy rates as high as 75 per cent — with little or no evidence of targeting the aid to firms or sectors that were particularly hard-hit. Take-up of the program did end up being highest in sectors that suffered the largest job losses in the pandemic, but it is difficult, given current data, to determine whether it was successful in preventing job losses. Moreover, the program discouraged business growth, while at the same time failing to exclude firms that would have naturally shut down between March 2020 and October 2021, even without the shock of the pandemic. Finally, the program came too late to ensure that connections between employers and employees were preserved during the first waves of shutdowns. This meant that individual workers took the Canada Emergency Response Benefit (CERB) instead and it’s likely that fewer maintained a relationship with their original employer than if the wage subsidy had been offered first.

By lowering the cost of retaining workers for struggling businesses, the program should have helped to reduce unemployment and keep incomes flowing. But at what cost? The problem is that CEWS was paid for all workers at affected businesses, not just those facing the prospect of job losses. Because of its poor targeting, a back-of-the-envelope calculation based on program data suggests that the fiscal cost of each person/month of employment saved through the program was about $14,500, or $188,000 per job/year.

Other labour market programs are better targeted to vulnerable jobs or workers. For example, the work sharing agreement program in employment insurance acts as a targeted wage subsidy to preserve jobs by temporarily subsidizing reduced hours of paid work when a previously viable business needs to temporarily reduce its payroll costs. The process of applying to the program is fairly onerous for employers precisely because the aim is to make sure the support is going to businesses who need it to preserve jobs but where the business can be expected to recover with some short-term help. Other evidence comes from extensive research on a demonstration project to test wage supplements paid to long-term unemployed people on benefits finds that the supplement significantly improved employment outcomes and generated a net reduction in the costs of income support.

The case for hiring subsidies

CRHP is a subsidy paid for increases in payroll expenditure by a firm, rather than for total payroll costs. As such, it may be better targeted to creating new jobs. While evidence on the effects of employment subsidies is mixed overall, research in other countries suggests that hiring subsidies can be more cost-effective than general wage subsidies.

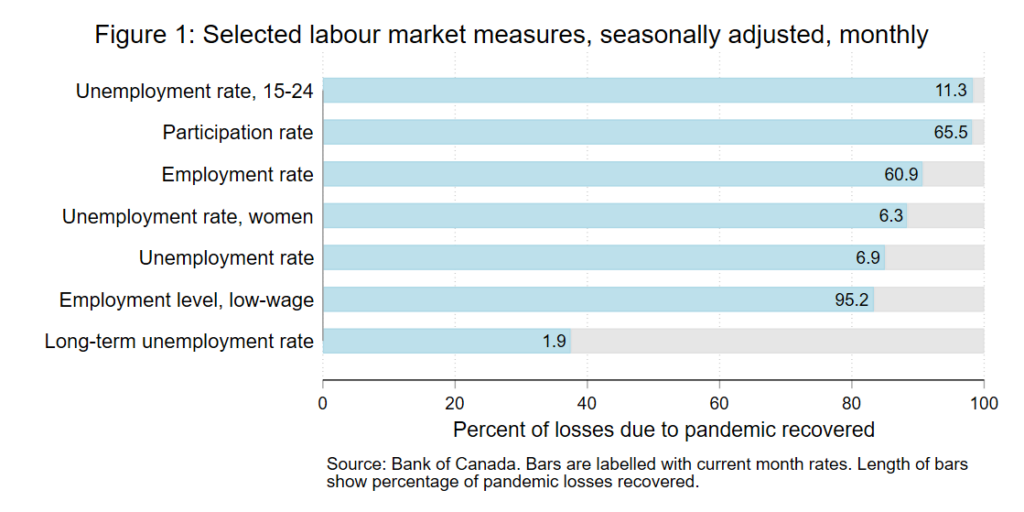

There are many reasons to be optimistic about the Canadian labour market, but there are also clear risks ahead and gaps left between where we are and where we were pre-pandemic. The labour force participation rate is back its to pre-crisis level, and unemployment is now much closer to the historic lows seen in 2019. However, average hours worked are still down, wages are not growing despite a much tighter labour market, and long-term unemployment is still twice as high as it was before the pandemic.

Active labour market policies are a variety of government programs designed to improve the functioning of labour markets – including wage subsidies, job-retention schemes, hiring subsidies, and redeployment efforts aimed at the long-term unemployed. Active labour market policies can make sense – when they are properly targeted.

Hiring subsidies may help to encourage more active job search among the unemployed and help eliminate mismatch in the labour market, creating a virtuous circle of job creation and job search.

As labour markets tighten over time, hiring subsidies may bid up wage offers, resulting in a pro-work system of transfers to the working poor. But much of the benefit of the subsidy inevitably goes to employers, not workers. That, too, may be desirable during the economic recovery: employers without easy access to capital suffering through the pandemic may find it easier to expand with the additional cashflow from hiring subsidies, helping to preserve viable businesses and viable jobs during the recovery.

Problems with CRHP

The CRHP should be expected to address the specific issues facing small employers in Canada. But we see problems in the design of the program that the recent expansion and extension may only exacerbate.

As noted earlier, the CRHP is available only to small businesses, defined as CCPCs and small co-ops. That could make sense if the labour market frictions described above are especially strong for small business employers. For example, small businesses might be reluctant to pay for fixed costs of renewing or expanding their workforce. Or they may be willing to take the risks but may have more limited access to capital relative to larger employers. That said, nearly half of Canadian workers are employed by large businesses, and excluding them from hiring under CRHP seems arbitrary in program intended to spur job creation and hiring.

Worse, CRHP enhances tax avoidance opportunities for small businesses. Salaries of family members of owners and other employees who are not at arm’s length are eligible for CRHP, so long as they had some pre-pandemic wage or salary from the company. This means that owners, and spouses, and siblings, and children, and grandchildren, and parents and grandparents who had any payroll compensation (dividend income is not eligible) before the pandemic are now eligible for a subsidy of up to 50 per cent on incremental increases to their pay over their compensation in mid-March 2021. We think this runs contrary to the goals of promoting job postings and improving labour force outcomes for workers that are currently unemployed or out of the labour force.

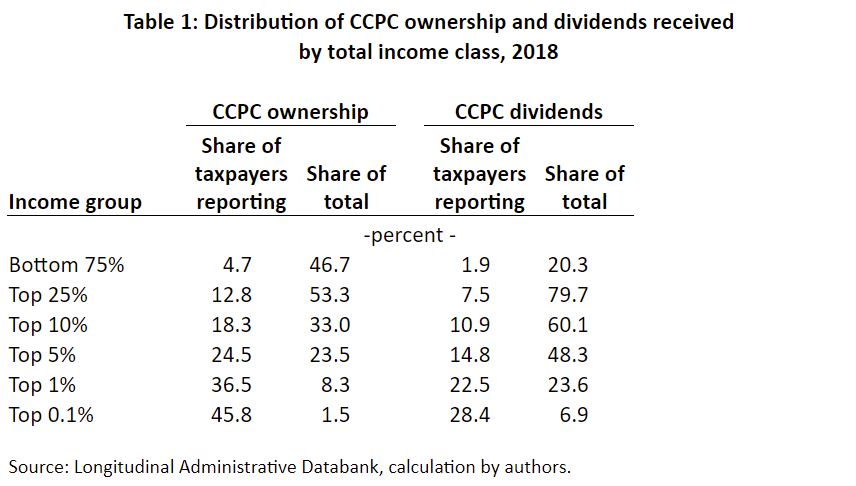

Support for “small business” is something of a talisman for all major political parties in Canada, seen as an uncontroversial goal. But the reality is that many small business owners have high incomes. Table 1 shows the distribution of CCPC ownership by taxpayers’ total income from tax return data for 2018. More than half of CCPCs (53.3 per cent) were owned by taxpayers in the top 25 per cent of the income distribution, whose average income excluding capital gains was $118,830. In the bottom 75 per cent of incomes, only 4.7 per cent of taxpayers owned any CCPCs.

Even these figures may understate the potential inequity of transfers to small business owners, since they include inactive businesses, which may be owned disproportionately by low-income taxpayers. A better measure of active business may be receipt of dividends from CCPCs, shown in the rightmost columns of the table. By this measure, inequality in CCPC activity is more extreme. Nearly half of CCPC dividends (48.3 per cent) were received by taxpayers in the top five per cent of incomes (average income $1.15 million), and only 1.9 per cent of taxpayers in the bottom three-quarters of the distribution reported any CCPC dividends at all.

The CRHP excludes dividend income, and this is wise. But the eligibility of existing family payroll employees for CRHP gives small business owners the opportunity to use the program for personal gain, even without hiring new staff.

We also note that the revenue drop threshold for the CRHP is set at a relatively modest 10 per cent decline, relative to the pre-pandemic baseline period. Given the over-representation of incorporated professionals among CCPC owners, we expect that billing and accounting practices could enable many dubious claims for this wage subsidy. After expending so much political capital to try to clamp down on dividend income sprinkling and tax-sheltered passive income in CCPCs in 2017, it seems strange that the government is investing so heavily in this particular program, while equipping it with so few guardrails against abuse.

Transparency lacking

While it is difficult to imagine, the CRHP has even less transparency that CEWS did. It has been in place since June 2021, but the government hasn’t yet made any program data public at all. We have no baseline to compare or track program use. When firm-level data on CEWs was scrubbed from federal government websites for some time (it has now returned), at least the government has consistently published aggregate data on applications and payments in each claim period. But the CRHP has no such comparable information, five months after it launched. The government seems to have addressed the criticisms of CEWS that came about from investigations using records of publicly traded companies by just excluding publicly traded companies altogether, whether they might be locations for job growth or not.

It’s perhaps not overly cynical to imagine that the choice to focus support on private corporations reflects the optics of the programs more than the economics. A report by Finances of the Nation last year identified over 4,000 CEWS recipients in 2020 that were part of large corporate groups, including many owned by Canadians on the billionaires list. Media reports used public financial reports to link CEWS payments to dividend and executive compensation payouts by publicly traded companies. Restricting support to private companies does little to improve the incidence of the subsidies. But it does reduce the risk of embarrassing disclosures through public corporate filings.

Conclusions and recommendations

First, the program ought to be revised to measure growth in the number of employees on payroll, not just aggregate payroll costs. In their regular payroll remittances to the CRA, employers are required to report not only aggregate totals for gross pay and amounts withheld, but also the count of employees in the last pay period. Employers should be able to demonstrate that they are hiring new workers, not just paying current workers more, particularly in cases where many on payroll won’t be at arm’s length from the business owner. We note that this and other flaws in the design of the CRHP (and CEWS) might have been easier to anticipate and mitigate if the government had already embraced detailed monthly payroll remittances, also known as e-payroll.

Second, the government ought to make detailed program data available, retroactive to the start of the program in June and in real-time for the duration of the program. How many firms have received the subsidy? What firm size, industry sectors and regions do they represent? How many workers’ wages or salaries have been subsidized? Until the government publishes and updates the data, we will have no way of knowing.

Third, the CRHP rule requiring only a 10% revenue drop relative to a somewhat arbitrary period in Spring 2021 could be improved by at least using the same two-key system that the government is adopting for other pandemic relief to businesses. To ensure that predictable and seasonal revenue changes don’t trigger eligibility for a generous subsidy, businesses might also be required to show a drop in revenue over a 12 month period, relative to their pre-pandemic earnings.

Jennifer Robson is an associate professor of political management at Carleton University.

Jennifer Robson is an associate professor of political management at Carleton University.

Michael Smart is an economics professor at the University of Toronto and co-director of Finances of the Nation.

Michael Smart is an economics professor at the University of Toronto and co-director of Finances of the Nation.