Michael Smart

To address wealth inequality and to improve functioning of our tax system, tax rates on capital gains income should be increased. The current tax preference for capital gains costs upwards of $15 billion annually. Increasing the rate of taxation on capital gains would constitute a simpler, more efficient way of taxing high-wealth individuals compared to other recent proposals for a novel annual wealth tax, and would likely raise more revenue as well.

There has been much concern about wealth inequality in recent years, with renewed attention during the current economic crisis. There have been carefully reasoned proposals for a new annual tax on wealth, and more recently the federal NDP has proposed a tax on “excess profits” during the pandemic.

But before introducing entirely new taxes, why not fix the existing tax system? Recently at Finances of the Nation, my colleagues Ken McKenzie and Allan Lanthier have made a persuasive case that existing design features and loopholes make our system of taxing capital income both inefficient and unfair. In this Commentary, I address in more detail one aspect of the system: the taxation of capital gains.

Capital gains and inequality

Capital gains are income flows that result from the rise in value of corporate shares and other assets. But capital gains are taxed quite differently than labour earnings and other kinds of ordinary cash income. In the Canadian system:

- Only 50 percent of realized capital gains are included in taxable income, so that the effective personal tax rate on gains is half that of other income.

- Taxpayers may claim a lifetime exemption from tax on realized gains up to $883,384 on farm properties and small business shares, and gains on principal residences are entirely exempt.

- Capital gains, when taxed, are taxed on a realization basis; that is, only when the asset is disposed of, rather than when the gain accrues. Because a capital gain increases the wealth of the owner, it is a form of income, even if no cash changes hands. The deferral of taxation until realization confers a tax advantage, and it also affords investors the opportunity to time gains and losses to reduce taxes.

- Capital gains tax avoidance also plays a crucial role in estate planning. Although there is in principle deemed realization of gains at death, taxpayers can engage in “estate freezes” and other sophisticated transactions to defer capital gains taxes, giving their beneficiaries additional tax advantages.[1]

In all, capital gains income is taxed very lightly in our system – when it is taxed at all.

Table 1 Distribution of tax benefits from partial inclusion of capital gains

| Total income range | Percentage of taxfilers reporting gains | Average capital gains | Average tax savings | Share of taxable capital gains | Share of total tax benefit |

| Total | 11% | 24406 | 5584 | 100% | 100% |

| Under $100,000 | 9% | 7156 | 1179 | 22% | 16% |

| $100,000-150,000 | 22% | 20563 | 4376 | 10% | 10% |

| $150,000-250,000 | 33% | 42257 | 9827 | 13% | 13% |

| $250,000 and over | 52% | 249603 | 64063 | 55% | 61% |

(Source: Canada Revenue Agency, T1 Final Statistics, 2017)

Because most capital gains income is realized by high-income taxpayers, these tax preferences are highly unequally distributed. Table 1 shows the extent of this inequality, based on the most recent data released by the Canada Revenue Agency. In all, Canadians realized $72.9 billion in taxable capital gains. Of the total, 54.6 percent was declared by taxpayers with incomes over $250,000. More than 80 percent of gains were declared by the 9.5 percent of Canadian taxfilers with total incomes over $100,000.

Fiscal cost of partial inclusion of capital gains

To calculate the fiscal cost of the partial inclusion of capital gains, we can compare taxes actually paid on gains to what would be paid if they were taxed as ordinary income (and assuming that there were no behavioural responses to the higher tax rates). To do so, I multiplied the average amounts of excluded capital gains implied by the data in column 2 of Table 1 by the average marginal tax rate in the relevant income range. The resulting estimates of average tax savings are reported in column 3. (Note that the average amounts reported are for individuals in the income range with positive capital gains income, excluding the zeroes.)

Based on the figures in this column, I estimate the total fiscal cost[2] of partial inclusion at $15.7 billion in 2017. This amount is larger than the amount listed in the federal Tax Expenditure reports, because I include the impact on provincial as well as federal tax revenue. Note also that the calculation reported here excludes the lifetime capital gains exemption, which I estimate cost an additional $3.2 billion in 2017.

Observe that the tax savings disproportionately benefit high-income taxpayers. The average top-bracket taxpayer with gains saved $64,063 in 2017 due to the reduced rate of taxation on capital gains. More than 60 percent of tax savings went to this group, which is just 1.1 percent of taxpayers.

It is entirely unclear what economic benefits are derived from this tax expenditure of about $16 billion annually. The federal Department of Finance says that the measure is “to encourage or attract investment … savings [and] to support competitiveness”. But, as Ken McKenzie argues, there is little reason to believe that tax preferences aimed at domestic investors alone have an impact on capital employed in Canada. It is sometimes suggested that capital gains taxes discourage risky investments. But, as Jack Mintz has argued, a capital gains tax that treats losses and gains symmetrically has no impact on risk taking.

A tax on realized capital gains in principle creates an incentive to delay realizations to avoid taxes, a phenomenon known as the lock-in effect. Some argue that a capital gains tax increase could therefore create an inefficient friction in capital markets, and lead to revenue losses, as investors become reluctant to sell assets with accrued gains.

Reviewing the evidence from previous empirical studies, Ken McKenzie concludes the magnitude of the lock-in effect is probably small. Recent research by Agersnap and Zidar appears consistent with this conclusion. What is more, because the benefit of tax deferral is proportional to interest costs, it is probably much smaller now in our current low interest rate environment than in the 1990s and early 2000s, the period examined in most empirical studies of the lock-in effect. And, since the lock-in effect only delays realization of gains rather than eliminate them, it would have only a small impact on long-run tax revenues from a tax rate increase.

Corporate-personal tax integration

Capital gains income from corporate shares has already been taxed once, when the underlying income was earned by the corporation. In a fair and neutral tax system, it makes sense to recognize corporate taxes already paid and adjust personal taxation of corporate distributions accordingly. As I explain in detail elsewhere, the Canadian system achieves this for dividend payments through the “gross-up-and-credit” system, which provides shareholders with a credit for corporate taxes deemed to have been paid already.

Arguably, partial inclusion serves the same purpose for capital gains income, reducing personal taxes to allow for corporate taxes already paid on earnings.

But, if integration is the goal of partial inclusion, then the inclusion rate must now rise.

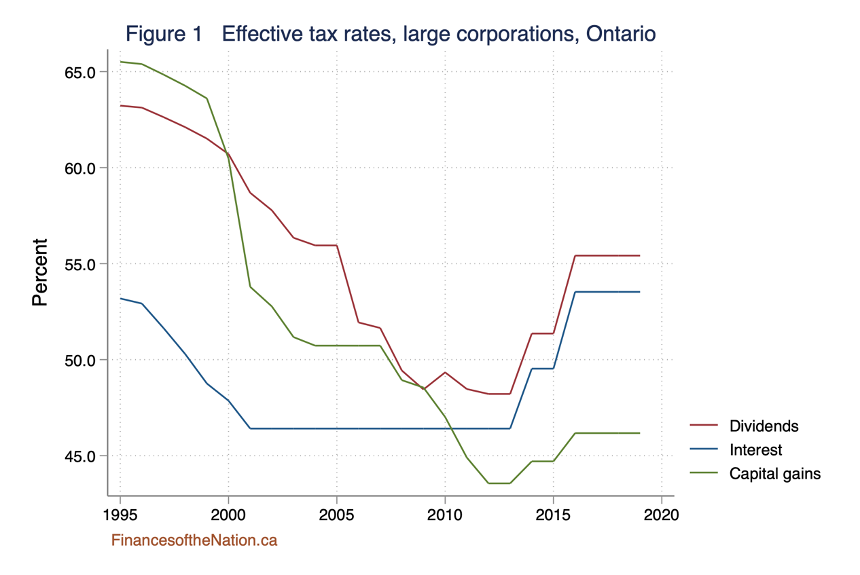

To illustrate this, Figure 1 shows the effective tax rate since 1995 on interest payments, dividends, and capital gains received from an investment in a large taxable Ontario corporation. Effective tax rates represent the full tax at corporate plus personal level on $1 in pre-tax corporate earnings paid out and received by a top-bracket investor residing in Ontario. Because interest payments are deductible for the corporation, the effective tax rate on interest is simply the investor’s personal tax rate, which is now 53.5% at the top in Ontario. With full integration, dividend and capital gains income would pay the same effective tax rate.

Following reforms enacted in 2006, the dividend tax credit is now set to ensure full integration for dividend income. As shown in the figure, the tax rates for interest and dividends have now nearly converged.

But we have “over-integrated” for capital gains. The effective tax rate on gains has fallen, beginning with the 2000 reform that reduced the inclusion rate from 75% to 50%, and continuing over time, as corporate tax rate reductions have made gains even more favourably taxed. The effective tax rate on gains is now 9.2 percentage points below that on dividends for top bracket investors in Ontario, and 8.1 points on average across the provinces

This is a tax break to high-income shareholders that serves no economic purpose. In fact, it is a non-neutrality in the tax system that has negative consequences for productivity. It encourages firms to reduce dividends and pay out earnings through share repurchases and corporate acquisitions that attract capital gains treatment in place of dividend tax treatment.

Other high-income countries do not have the same preference for capital gains in their tax systems. Although the details of national systems differ, most countries tax income from capital gains at rates comparable to or higher than dividends. In the United States since a 2003 reform, qualified dividends and long-term capital gains have been taxed at about the same rate. While Australia’s capital income tax system is similar to Canada, it achieves neutral tax treatment for dividends and gains. Among high-income Anglosphere countries, only the United Kingdom taxes gains less than dividends, although not to the same extent as Canada does.

Capital gains and small business

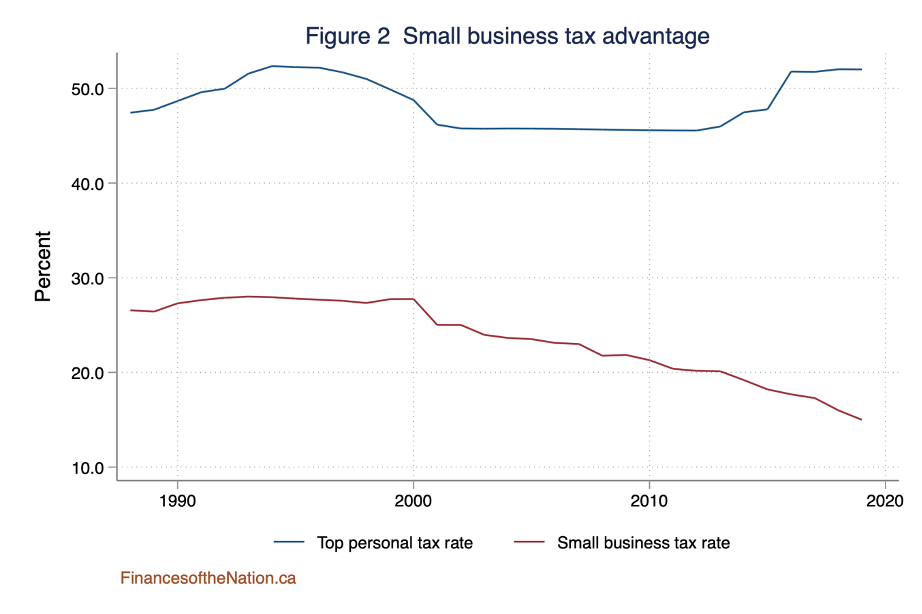

Canada imposes very low corporate tax rates on small businesses. On average across the provinces, the corporate tax rate for small Canadian-controlled private corporations (CCPCs) is now 15 percent, compared to an average top personal tax rate of 52 percent. As shown in Figure 2, the gap between corporate and personal rates has widened in recent years.

The low rate is intended to reduce the tax burden on small business investment and thereby facilitate growth. But there is a great potential for small businesses simply to become tax shelters in which business owners shield income from high personal tax rates. To make the system work as intended, corporate-personal tax integration must be designed carefully to ensure that distributions from small businesses are ultimately fully taxed at the business owner’s own personal tax rate.

As Allan Lanthier has recently argued, the current integration system does not work well. Small business owners now have strong incentives to find ways to extract corporate profits as capital gains rather than dividends or wages, to get the benefit of lower taxes on gains. (These “surplus stripping” transactions are financially sophisticated, but in essence they typically involve the business owner establishing a second corporation to “purchase” shares of the operating company with retained earnings, resulting in a cash distribution that is treated as a capital gain.)

Surplus stripping creates real economic costs. The expertise and resources being used to create and manage tax shelters merely generate a tax benefit for the taxpayer at the expense of government revenue, with no overall social benefit. Meanwhile, tax authorities must devote considerable resources to finding and eliminating novel tax shelters, leading to unnecessary complications in the tax law in the process.

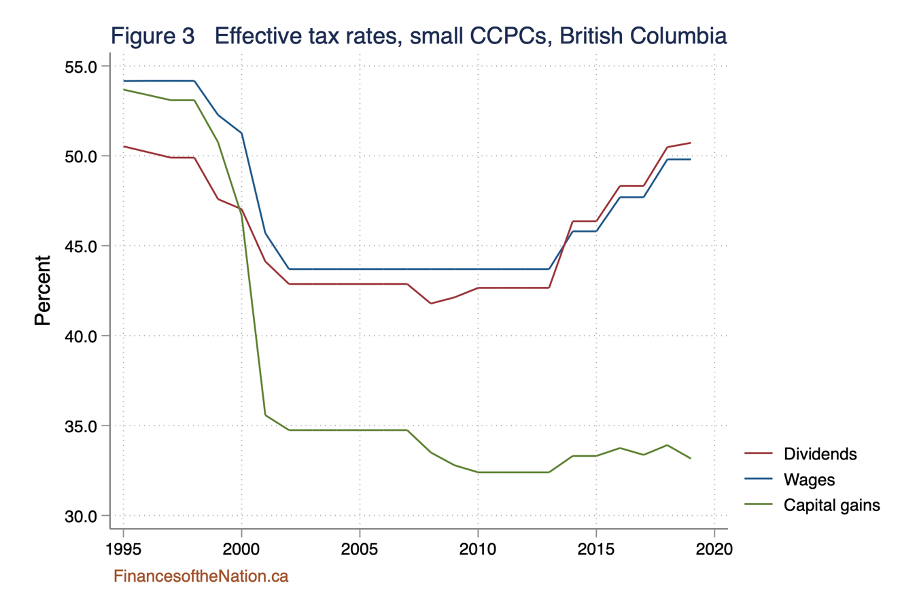

Here again, the problem is that capital gains tax rates are too low to ensure integration. Figure 3 illustrates how large this problem is, showing effective tax rates on distributions from a small business to an owner located in British Columbia. A small business owner could pay herself a wage that is deductible at the corporate level but fully taxable at the personal level, pay a dividend from corporate surplus, or retain earnings and receive income as a capital gain on the sale of shares. Again, the system achieves integration and neutrality for dividend payments, but not for capital gains. For small businesses, the tax advantage for capital gains is more than 16 percentage points in British Columbia, and ranges between 15 and 22 points across provinces. And so the incentives for surplus stripping by small businesses are large.

The required reforms

This Commentary has made the case that reduced tax rates on capital gains are inequitable, and they serve no productive purpose. A capital gains tax increase would be a form of annual “wealth tax” that would be very simple to implement within our current system, would cost no more to collect (and probably less), while reducing the economic costs of tax avoidance behaviour. What is more, a capital gains tax increase would like generate far more revenue than proposals for a novel wealth tax currently entertained in Canadian political circles.

So the capital gains inclusion rate should rise. But how much? One attractive approach is to focus on the failures in corporate-personal tax integration highlighted in Figures 1 and 3, and to choose inclusion rates that equalize the effective tax rates on dividends and capital gains. This would achieve neutrality for different forms of corporate distributions, and eliminate the incentives for share repurchases and surplus stripping described above.

The inclusion rate required to achieve neutrality differs for large corporations and small CCPCs, because of the difference in their corporate tax rates, and the resulting difference in their Dividend Tax Credit rates in our current system. The precise inclusion rate to achieve neutrality differs from province to province, depending on corporate and personal tax rates there. Raising the inclusion rate to 70 percent would achieve neutrality on average for large corporation shares. For small businesses, because of the smaller tax credit for non-eligible dividends, the inclusion rate must rise to 90 percent before dividends and capital gains face the same effective tax rate.

One possible approach to achieving neutrality would therefore be to create a distinction in the tax system between capital gains from the sale of qualified small business shares and other corporate shares, analogous to the existing distinction between non-eligible and eligible dividends. But this would increase complexity in the tax system, and it could create new avoidance opportunities. An alternative is to raise the inclusion rate to 75 percent for all gains on shares, which would achieve near neutrality in all cases.

The focus on neutrality for dividends and capital gains raises the issue of how to treat other non-corporate assets, including personal use property such as works of art and vacation homes. Here again, the arguments for higher inclusion are strong. The return to holding such assets is not generally subject to corporate incomes taxes, so that reduced tax rates are not required in these cases to achieve corporate-personal tax integration. There is a strong case for taxing them fully through the income tax system, with no preferential treatment relative to labour income.

Raising the inclusion rate to 75 percent would increase income tax revenue substantially. Based on the data reported in Table 1, I estimate that federal and provincial personal income tax revenue would have been $7.8 billion higher in 2017. To eliminate tax avoidance opportunities, the inclusion rate should also rise to 75 percent for capital gains realized by corporations. Doing so would generate an estimated additional $8 billion in federal and provincial tax revenues.[3] In all, the proposed reform would generate an estimated $15.8 billion, or 4.7 percent of total federal and provincial income tax revenues.

The additional revenue from this proposal would far exceed what could plausibly be obtained from a new annual tax on high-wealth individuals. The Parliamentary Budget Officer recently evaluated one proposal for such a tax, a one percent tax on individual wealth portfolios in excess of $20 million, estimating that it would raise $5.6 billion in annual revenues. A new wealth tax would also have significant administrative costs and enforcement problems, and arguably it would exacerbate inter-asset tax distortions, harming productivity. An increase in capital gains tax inclusion would raise more revenue, while achieving tax neutrality for different assets, which has advantages for productivity. The case for an increase in capital gains taxation seems clear.

[1] For this and other issues in tax planning with CCPCs, see Wolfson, M., Veall, M., Brooks, N. and Murphy, B., 2016. Piercing the veil: Private corporations and the income of the affluent. Can. Tax J., 64, p.1.

[2] The estimated total tax saved due to partial inclusion is $16.7 billion, based on the data reported in Table 1. But tax on capital gains is partially offset by declared Net capital losses of other years, which I estimate reduced the net total tax expenditure to $15.7 billion per year.

[3] The Department of Finance’s Tax Expenditure Report put the federal cost of partial inclusion for corporate gains at $10.0 billion in 2017. I estimate that raising the rate would increase federal revenue by one-half of that amount, and would raise provincial revenue by 30 percent of that amount.