John Lester

Canada’s innovation policy framework could be changed for the better. Unfortunately, not all the measures proposed in the Conservative platform offer clear-cut improvements.

The Conservative party has adopted the “Canada first” approach to innovation policy articulated by the Council of Canadian Innovators (CCI). The CCI has criticized existing government policy as favouring a branch-plant economy in the era of intangibles, much as it did in the era of tangible production. According to the CCI, government policies have favoured the expansion of foreign technology branch plants over encouraging the growth of innovative Canadian firms (Council of Canadian Innovators 2020).

Following the lead of the CCI, the Conservative party’s election platform includes measures to favour the development of innovative Canadian firms, including limiting access to innovation funding to Canadian-controlled firms, imposing performance criteria on recipients, and requiring that intellectual property developed with government funding remain in Canada. The Conservatives propose to provide more support to small business by taking the savings from preventing foreign-controlled firms from accessing the Scientific Research and Experimental Development (SR&ED) tax credit and allocating those savings to small Canadian-controlled firms. The party platform also recommends increasing the overall support for innovative firms by implementing a “patent box” regime and allowing technology firms to issue flowthrough shares, which would provide indirect refundability of deductions and credits.

Canada’s innovation policy framework could be changed for the better. Unfortunately, not all the measures proposed in the Conservative platform offer clear-cut improvements. Implementing a patent box regime is the most promising policy initiative in the Conservative platform. Properly designed, it would provide an incentive to perform more R&D, commercialize more of it in Canada, and declare more of the income earned from commercialization in Canada. A patent box regime could be an effective substitute for imposing performance criteria on SR&ED recipients. Making SR&ED deductions and credits refundable is worth considering, but allowing technology firms to issue flowthrough shares would be more expensive than direct refundability. The proposal with the least merit is to increase support for R&D performed by small firms. Subsidies available to small firms through federal and provincial SR&ED tax credits are already excessive.

Why do governments subsidize R&D and not its commercialization?

When firms perform R&D, they create knowledge that allows them to introduce new products, improve existing goods and services, or reduce production costs. However, some of the knowledge created inevitably leaks out or spills over to other firms, allowing these other firms to reap benefits from R&D without performing it themselves. These spillover benefits improve Canada’s overall economic performance, but firms do not consider that when deciding how much to invest in R&D, so there is a prima facie case for a subsidy to encourage more R&D. However, subsidizing R&D has costs as well as benefits, so a careful assessment is required to determine if subsidization results in a net social benefit (Lester 2021).

Many commentators draw attention to the additional jobs created while both performing and commercializing R&D, citing the additional employment as a benefit. However, a permanent subsidy cannot increase the total number of jobs in the economy. The additional jobs created by the subsidy will be offset by losses caused by the higher taxes or lower government spending required to finance the subsidy. Government support will therefore affect the composition, rather than the level, of employment.

Other commentators, such as the CCI, draw attention to the quality of jobs – including relatively high wages — created by innovative firms, implicitly suggesting that subsidy-induced changes in the composition of employment will raise overall income. Jim Balsillie, chair of the CCI, makes the more general point that innovative firms, by implementing new processes or bringing new products to market, earn above-normal profits, or rents, that can be shared by investors and workers. These rents also result in higher tax revenue, which is of benefit to the broader economy. Balsillie (2021) advocates a policy framework that enables Canadian companies to “capture their fair share of rents in the intangibles economy.”

The CCI “industrial policy” approach contrasts with the conventional view that there are no market failures preventing potentially profitable innovations from coming to market and hence no need for government support. However, the case for encouraging the growth of sectors earning rents is ambiguous. One concern is that it can be difficult to identify sectors that are earning rents. Relatively high wages may reflect skill differences rather than rents, and relatively high profits may include compensation for risk. In addition, rents may be confined to a small number of firms in an industry.

A second consideration is that even if the existence of rents can be demonstrated, careful analysis is required to determine if the benefits of support exceed the cost. Rents represent a transfer of income from consumers to producers. As a result, they raise national income if they are realized on sales to foreign consumers or if domestic sales displace imports that generate rents for foreign producers. This increase in national income has to be balanced against the costs of providing the subsidy, which include transfers of the subsidy to foreigners via sales on world markets and profits of foreign-owned firms performing R&D in Canada, administration and compliance costs, and the cost of raising taxes or cutting spending to finance the subsidy.

Finally, the policy raises fairness issues. The additional rents accrue to the investors and workers in the firms making the innovation. While the rest of society shares in these rents because they are taxed, the distribution of benefits is skewed to the relatively well-off. To avoid a regressive outcome, the subsidy should be financed by taxes on the relatively well-off or by reductions in program spending that benefits high-income individuals. This could be achieved, for example, by financing the subsidy through personal income taxes or surcharges on incomes above a certain threshold. But the fairness of having one group of high-income individuals bear the cost of the subsidy that primarily benefits another high income group needs to be carefully considered.

Proposed changes to the SR&ED tax credit

Summary of the SR&ED investment tax credit [1]

The federal government provides a tax credit equal to 15 per cent of current expenditures on R&D by large firms and 35 per cent for expenditures by Canadian-controlled small- and medium-sized private corporations.[2] For convenience, these two categories are labelled large and small firms. Small firms can apply for the 35 per cent subsidy on up to $3 million in R&D investment. The expenditure limit is reduced to zero as capital assets rise to $50 million from $10 million. The tax credit is refundable for small firms, making it equivalent to a direct subsidy, but must be used to reduce taxes that are otherwise payable for large firms. Large firms that do not have enough taxable income to claim the credit as it is earned may carry unused credits forward up to 20 years and back three years.

All provincial governments except Prince Edward Island offer tax credits for R&D performed within their borders. Provincial credits are refundable for all firms in the Atlantic provinces, Quebec and Manitoba. Ontario, Saskatchewan, and B.C. offer refundability for small firms only. Alberta offers a refundable “grant” through the tax system to small firms only. Most provinces use the base and the expenditure limit defined by the federal government. The key exception is Quebec, where the base is labour costs and 50 per cent of outsourced R&D. The weighted average provincial statutory rate is 42.1 per cent for small firms and 20.1 per cent for large firms.

The effective subsidy rates on R&D are lower than the statutory rates because not all spending on R&D is included in the base for the credit: capital expenditures are excluded and only 80 per cent of eligible R&D that is outsourced is included. In addition, the base for the federal credit excludes all other sources of government funding.

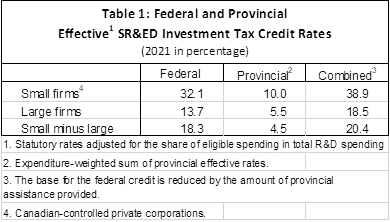

These adjustments result in a combined federal-provincial effective subsidy rate for small firms of 38.9 per cent and 18.5 per cent for large firms. (Table 1). A substantial number of small firms receiving SR&ED tax credits also benefit from subsidies provided by the Industrial Research Assistance Program (IRAP). Based on information for the 2008 to 2011 period obtained via an Access to Information request, I estimate that the average combined subsidy rate for these firms is about 60 per cent.

Changes to the administration of the credit

The Conservative platform describes the SR&ED tax credit as a “badly-broken administrative nightmare” in which 25 per cent of the benefits are absorbed in compliance costs. To reduce compliance costs, the Conservative platform proposes shifting administration from the Canada Revenue Agency (CRA) to Industry, Science and Economic Development (ISED) with personnel from the Industrial Research Assistance Program (IRAP) of the National Research Council (NRC) determining eligibility for the credit.

There is unavoidable friction between ease of access and maintaining the integrity of R&D support programs. These programs have a net benefit for society only if they subsidize the creation of new knowledge. Perfunctory review of proposals will improve takeup and user satisfaction but will reduce the net social benefit of the program. Program administrators must therefore take measures to ensure that subsidized spending meets the requirement that it create new knowledge. Even with clear eligibility criteria and sensible risk-based verification procedures, there will be a cost to maintaining program integrity and some unhappy clients.

The CRA has modified its procedures to make the program more accessible while maintaining its integrity. Since 1999, CRA has implemented and enhanced pre-claim project reviews, process reviews, personalized account services, and a first-time claimant advisory service.[3] A key objective of these initiatives is to improve the speed and predictability of the claims process, which is often described as reducing eligibility risk. While there may be some unexploited opportunities to improve delivery of existing services or to reduce costs, simply shifting administration from CRA to ISED/IRAP (or to the NRC) may not be one of them. Resources have to be allocated to determining if SR&ED claims qualify as R&D (i.e., if they will create new knowledge). It may be that IRAP personnel are better-qualified than their CRA counterparts to assess projects, but this advantage would be reduced by additional costs from co-ordinating between the two agencies. A simpler solution to this problem, if it exists, would be to ensure that CRA is able to hire the same quality personnel as IRAP.

The Conservatives’ estimate of compliance costs is too high. The Jenkins Expert Panel on Research and Development commissioned a survey on compliance costs for SR&ED and IRAP (Jenkins et al. 2011). For small firms making an SR&ED claim, compliance costs amounted to approximately 14 per cent of the value of their credits. The corresponding figure for large firms is approximately five per cent. As reported in Lester (2012), the weighted average cost for all firms is about 8½ per cent.

Exclude large foreign-controlled firms

The Conservative party is proposing to exclude foreign-controlled firms from the SR&ED tax credit and use the savings to provide more support to small Canadian-controlled private corporations. Large foreign-controlled firms performed 38 per cent of R&D in Canada on average over the five years ending in 2019.[4] I estimate that large firms account for almost 80 per cent of R&D performed in Canada, so foreign-controlled firms account for slightly less than half of R&D performed by large firms.

The fiscal cost of the large firm credit in 2019 was $880 million (Finance Canada 2020), down from a peak of $1.54 billion in 2017. The decline occurred despite an increase in overall spending on R&D, which may mean the large-firm share declined or that economic conditions made it more difficult to claim credits as they were earned. If claims rebound to their previous peak over the next several years, the fiscal saving from preventing large foreign firms from making SR&ED claims will be about $750 million on an accrual basis and about $380 million on a cash basis.[5] Additional funding of this magnitude would increase the small-firm subsidy rate by seven to 14 percentage points, pushing the effective subsidy rate into the 39-to-46 per cent range.

To be considered sound public policy, the proposed reallocation should increase the net social benefit of the SR&ED tax credit. In an earlier paper (Lester 2021), I presented benefit-cost analyses that showed the large-firm credit results in a substantial net benefit. Recall that spillovers from new knowledge created are the reason for subsidizing R&D. Foreign and domestic large firms perform basic research, applied research, and experimental development in roughly the same proportions,[6] so it would be reasonable to assume that the two classes of firms generate similar spillovers. Profit outflows, which reduce the net social benefit of the subsidy, will clearly be higher for foreign-controlled firms than for the large-firm average. However, while the net benefit from subsidizing foreign firms is smaller than for the large-firm average, it is still positive. Further, the net benefit from subsidizing large foreign-controlled firms is greater than the net benefit from subsidizing small firms, which means that the proposed reallocation would harm, rather than help, economic performance in Canada.

Many readers will find this result surprising. The main reason for the gap between the net benefit for the two credits is that large firms generate much larger spillovers than small firms (Kim and Lester 2019). In addition, as noted above, compliance costs represent a much higher share of the tax benefit for small firms than for large firms. A further consideration is the much-higher subsidy rate for small firms. As the subsidy rate increases, the required market rate of return on R&D falls, so firms undertake projects that would not be profitable without the subsidy. This puts downward pressure on the net benefit. This is an even more important consideration for the firms that receive both IRAP and SR&ED subsidies.

Other restrictions on recipients of innovation funding

In addition to excluding foreign-controlled firms from innovation programs, the Conservative platform includes two other “Canada first” measures. First, intellectual property developed with a government subsidy must be held by a Canadian entity or the funding returned. Second, subsidy recipients must demonstrate that the production and profits arising from the financial support will remain in Canada. These conditions are similar to conditions imposed on IRAP recipients, who are required to demonstrate that funded projects will benefit Canada and who may have restrictions placed on the disposition of intellectual property developed with IRAP funding.[7]

These measures are motivated by the view that commercialization of R&D creates valuable rents. There is also an implicit assumption that rents from the sale of the intellectual property to foreign entities are not as valuable as rents from commercialization in Canada. Given the choice between selling and exploiting the intellectual property in Canada, firms will choose the option that maximizes their rents. Imposing restrictions on the sale of intellectual property will therefore result in lower private rents. However, imposing restrictions may have other social benefits. For example, by encouraging more commercialization in Canada, the restriction could increase the demand for skilled labour in Canada and the (smaller) rents may be shared between workers and investors. The impact on general tax revenue is difficult to predict, but since employment income is taxed at a higher rate than capital gains, the restrictions could result in higher tax revenue despite smaller rents. On the other hand, implementing these measures would increase administration and compliance costs of the SR&ED tax credit. Implementation would also lower the expected return to R&D, which would reduce program takeup and the amount of R&D performed.

Implement a patent box regime

The Conservative platform includes a measure to tax the income generated from exploiting a patent at 50 per cent of the regular corporate income tax rate. As discussed in Lester and Warda (2018), a carefully designed patent box would do much to encourage both Canadian and foreign-controlled firms to undertake more R&D and to commercialize more of it Canada. It could also discourage shifting of commercialization profits to lower tax jurisdictions. The “carrot” provided by a patent box could be an attractive alternative to the “stick” of intellectual property restrictions.

The key design feature is to respect the OECD-sponsored requirement that there be a link or a “nexus” between the income taxed at a preferential tax rate and the expenditures undertaken to generate that income. With this link, income-based measures indirectly subsidize R&D while encouraging the retention of commercialization activity and the associated taxable income, without encouraging profit-shifting from other jurisdictions.

A second important design feature is to apply the preferential tax rate to all the income that arises from the commercialization of R&D, not just patent income, resulting in what is often described as an “innovation box”. Restricting coverage to income arising from patents causes distortions in the type of R&D undertaken and in the decision to protect intellectual property with patents or by other means.

A third consideration is whether the tax preference should be in addition to, or a substitute for, existing support. As discussed above, subsidies for R&D performed by small firms are very high and further increases would harm, rather than help, economic performance. A tax preference provided to small firms through an innovation box should therefore be accompanied by a reduction in other support. For large firms, the benefit-cost analysis in Lester (2021) indicates that support levels are too low in the sense that a higher subsidy would increase the net social benefit of the SR&ED tax credit.

The proposed 50 per cent reduction would lower the income tax rate by 7.5 percentage points. This is considerably larger than the equivalent U.S. measure achieved via the special rate on foreign-derived intangible income, which is about two percentage points (Lester and Warda 2020). It would therefore be reasonable to expect some additional commercialization activity in Canada at the expense of the U.S. On the other hand, the proposed reduction is lower than the 10 per cent median value in the 15 other countries that provide income-based tax incentives for R&D. Further, favourable tax-base shifting effects may not be large, since Canada may be competing with tax havens, such as the Cayman Islands and Bermuda, that do not impose corporate income taxes.

Flowthrough shares for technology firms

The Conservative platform includes a proposal to allow technology firms to issue flowthrough shares, inspired by the “very successful” results in the oil and gas, mining and renewable energy sectors. The issue being addressed is that the effective tax rate on startups and other unprofitable firms is higher than on profitable firms because deductions cannot be used as they are earned. Flowthrough treatment allows a firm to transfer unused tax deductions to outside investors, which lowers its effective tax rate. Flowthrough shares have an additional fiscal cost relative to the status quo because they allow deductions to be used earlier than otherwise, or prevent them from lapsing, and because they are deducted at the investor’s personal income tax rate, which will generally be higher than the corporate income tax rate.[8]

A key issue is whether flowthrough shares cost the government more than providing direct refundability. Information provided by Finance Canada and summarized in Lester (2017)[9] indicates that deductions claimed by flowthrough investors exceed the refundable amount by about one-quarter. In addition, the benefit is shared between investors and the corporation. Finance Canada (2013) estimates that issuing firms receive at most 58 per cent of the benefit. A potential offset to these findings is that weaker firms that would eventually fail will be unable to attract investors in their shares, which would reduce the cost of flowthrough treatment. There is not enough information available to rigorously test this proposition, but both Jog (2016) and Finance Canada (2013) report lower rates of return on flowthrough shares than on conventional shares, which suggests a smaller role than might be expected for investors in “screening out” weaker firms.

Overall, it is reasonable to conclude that direct refundability would be a cheaper option than the indirect refundability provided through existing flowthrough shares. A similar result is likely if technology firms were allowed to issue flowthrough shares. For large firms performing R&D, flowthrough shares could be structured to transfer either deductions or credits, or both. For small firms receiving the refundable tax credit, flowthrough shares would transfer deductions only. However, it is an open question if providing direct refundability for large firms performing R&D is good public policy. With refundability, multinational enterprises have a greater incentive to shift income to lower tax jurisdictions because the value of deductions and credits earned will decline. On the other hand, refundability has the advantage of increasing the effective subsidy rate on R&D to its target level for firms that are non-taxable firms for reasons other than income-shifting between jurisdictions, such as a cyclical downturn, unusual investment spending or other firm-specific events.

If direct refundability is deemed appropriate, the support provided should be in addition to assistance now provided to large firms but overall support levels should not increase for small firms.

Conclusion

SR&ED is not broken, but it could be improved. Unfortunately, the Conservative proposals are not likely to do that for the following reasons:

- While there may be some unexploited opportunities to improve delivery of SR&ED tax credits or to reduce the burden on firms, shifting administration from CRA to ISED/IRAP is not necessary to obtain these cost savings — if they exist.

- Preventing large foreign-controlled firms from accessing SR&ED tax credits and using the savings to increase support provided to small Canadian-controlled firms would harm, rather than help, economic performance.

- The impact of imposing performance criteria, including Canadian ownership of intellectual property, on SR&ED recipients needs to be carefully assessed. The benefits of imposing performance criteria could easily be offset by higher administration and compliance costs, and reduced program takeup.

Allowing technology firms to issue flowthrough shares to make deductions and/or credits indirectly refundable would be more expensive than direct refundability. However, making deductions and credits refundable for large firms has benefits and costs that should be carefully assessed.

In contrast, an innovation box is likely to be a cost-effective way of encouraging R&D and its commercialization in Canada. The “carrot” provided by an innovation box should be considered a substitute for the performance criteria “stick.”

There is evidence that the amount of support provided to large firms for performing R&D is too low, so any support arising from refundability and an innovation box regime should be in addition to existing measures. Support for R&D performed by small firms is excessive, so the impact of any new measures should be offset by reductions in the SR&ED tax credit rate.

[1] This is a modified version of material presented in Lester (2021).

[2] Smaller firms that are controlled by non-Canadians or listed on stock exchanges receive the regular credit..

[3] See Secretariat to the Review of Federal Support to Research and Development Expert Panel (2011) and “Evolution of the SR&ED Program – a historical perspective” for additional detail.

[4] Statistics Canada Table 27-10-0344-01

[5] On average over the five years ending in 2019, credits earned and used in the current year were 38 per cent of total claims.

[6] Statistics Canada Table 27-10-0344-01

[7] National Research Council. 2018. ‘Terms and Conditions, Industrial Research Assistance Program (IRAP).

[8] There are two other less important components of the fiscal cost. First, investors are allowed to deduct the full amount of the flowthrough shares, which will generally be higher than the value of the deduction transferred by the firm because it has more value to investors. Second, the fiscal cost is reduced by an additional capital gains tax payable because flowthrough shares are assumed to have a zero cost base for calculating capital gains.

[9] Lester, John. 2017. ‘Reviewing Federal Tax Expenditures’. In Income Tax at 100 Years: Essays and Reflections on the Income War Tax Act, edited by Jinyan Li, Scott Wilkie, and Larry Chapman. Canadian Tax Foundation/L’Association Canadienne d’Etudes Fiscales.