Jennifer Robson and Michael Smart

The FHSA would cost up to $1.4 billion annually, but much of the benefit would likely go to high-income households. Changes to the proposed program would make it more fair and more likely to encourage private savings by prospective first-time homebuyers.

While all parties in the current election have promised to address housing affordability, the Liberals have gone big with their proposed new First Home Savings Accounts (FHSA), and other tax measures aimed at first-time homebuyers. But is it the best approach?

In our view, housing affordability is an important challenge for governments, so subsidies aimed at first-time homebuyers could be warranted. But our analysis suggests the Liberals’ home savings accounts would be costly, with much of the benefit going to taxpayers with above-average incomes. And despite its name, the FHSA as proposed is unlikely to encourage young families to increase their own savings.

Since the 2008-9 global financial crisis, Ottawa has tightened its regulation of the mortgage market, making it harder to get a high-ratio mortgage, and bringing maximum amortization periods back down to 25 years, among other reforms.

That has probably been good for financial system stability overall, and particularly in some overheated local markets such as Toronto and Vancouver. But it has made homeownership more difficult for young, first-time buyers, who don’t have the financial assets or existing home equity that older buyers do. As a result, many current, young, first-time bidders may be getting priced out of at least some of Canada’s housing markets. It’s not just a problem in Canada. In a recent paper, Felipe Carozzi found that tightening credit conditions have affected young buyers disproportionately in the United Kingdom, too.

As part of a set of measures to improve housing affordability (both rental and ownership), it probably does make sense to help young buyers build up the financial equity needed to get into the homeownership market these days. But is the First Home Savings Account, proposed by the Liberal Party, the best way to do that?

Canada has tried homeownership savings accounts before

The FHSA is in many ways a direct copy of the now-defunct federal Registered Homeownership Savings Plan (RHOSP), introduced in November 1974. RHOSP was a tax-preferred account for any adult 18 and older who did not already own a home. Contributions were capped at (in nominal values) $1,000 per year and $10,000 over a lifetime. Annual contributions up to the limit were deductible from income. But unlike RRSPs, the funds in the RHOSP were not taxed at withdrawal so long as they were used to buy a home (or essential furnishing for a newly purchased home). Account balances not used to buy a home had to be withdrawn or transferred into a Registered Retirement Savings Plan (RRSP). In both cases, the withdrawal would be taxed, consistent with the deduction-deferral approach to tax-preferred savings accounts. In the 1977 budget, after some 400,000 RHOSPs had been opened, the federal government added two new conditions. First, unused balances after 20 years could no longer be rolled over into an RRSP. Second, going forward, the homeownership test would apply to both the accountholder and their spouse, if they had one. At that time, home sales were often conducted in the name of the husband only, making it appear as though the wife wasn’t an owner and was thus eligible for the RHOSP in her own right.

The RHOSP was eventually cancelled in the 1985 federal budget as a cost-saving measure, although households still had RHOSP balances at least as recently as the 1999 Survey of Financial Security conducted by Statistics Canada. During the debate on cancelling the RHOSP, policy-makers argued about whether it had helped to accelerate homeownership or had delayed it by encouraging would-be buyers to save more before house-hunting. In principle, targeted savings accounts can be used to encourage regular savings and delay a major purchase, but only if they are structured to discourage asset-shifting – moving existing assets into the new vehicle in a lump sum to collect the tax incentive, without delaying the planned purchase or generating new savings.

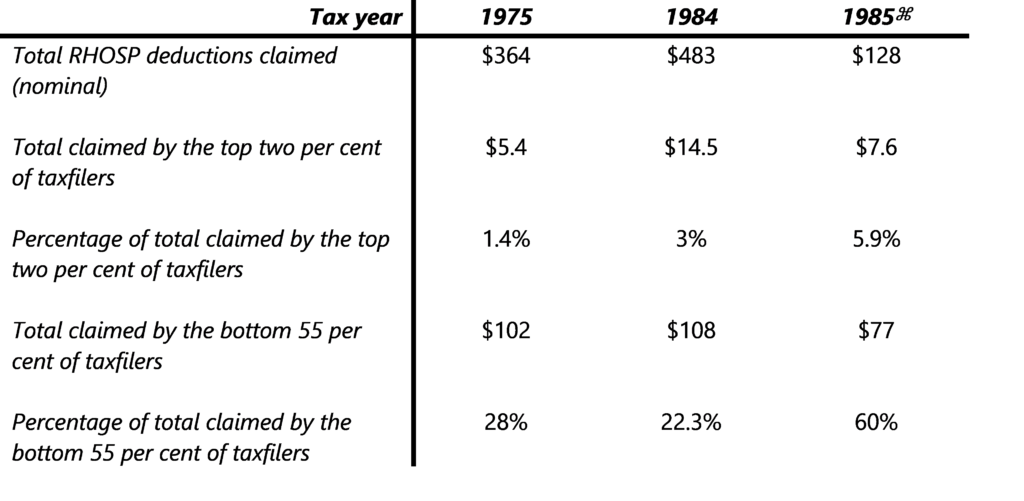

In the table below, we show data on the use of the RHOSP from T1 annual tax returns. In its early years, a larger share of the value of the foregone tax revenues benefited taxfilers in the bottom half of the income-distribution level, but towards the end of the program, the top two per cent (by income) of taxfilers were over-represented.

Table 1: Data on RHOSP deductions selected years ($ millions, nominal)

⌘ Data for 1985 would include only the partial tax year leading up to the federal budget in May.

Source: Author’s calculations using data in the Annual Tax Statistics, 1977, 1986 and 1987, Supply and Services Canada.

A detailed evaluation of the RHOSP by Gary Engelhardt concluded that use of the program had increased by 4.2 per cent with each 10 per cent increase in a taxfiler’s marginal tax rate. In terms of the impact on housing, the same study found that the RHOSP had raised overall rates of homeownership among participating taxfilers by about 20 per cent during the11 years it was in place. However, much of this result was driven by relatively smaller share of RHOSP users with higher marginal tax rates.

Following the demise of the RHOSP, the federal government also enacted in 1992 the Home Buyers’ Plan, allowing would-be homebuyers to borrow money from their own RRSP, without tax penalty, to use for the purchase of a first home. Withdrawals under the HBP have to be repaid over a 15 year time horizon, but about 35 per cent of users miss these repayments and have to pay tax on 6.7 per cent of their total HBP withdrawal in the tax year, accounting for up to 40 per cent of all taxable RRSP withdrawals in a given year, according to a 2011 study by Amin Mawani and Suzanne Paquette. A 2007 study by Marion Steele suggests that higher income earners are more likely to benefit from the HBP and less likely to miss a repayment, thereby triggering a tax penalty. Since both of those studies, the upper limit on HBP withdrawals has been increased to $35,000 per person and additional flexibility has been added to the eligibility rules about who qualifies as a “first-time” buyer. In short, the program seems to benefit better-off taxfilers who can already afford to save, and can then carry both new mortgage and other ownership costs, as well as repayment obligations into their RRSP.

The Liberals’ First Home Savings Account needs a rethink

Contributions to an FHSA account would be tax-deductible, withdrawals would be tax-free when used for home purchases, and unused balances could roll over into an RRSP. The FHSA would also have an age limit — only Canadians under age 40 could contribute. The Liberal platform says each account would have a lifetime limit of up to $40,000, but there is no mention of annual contribution limits. The platform also notes that a young person could “set aside 100% of every dollar they earn” in the new account, suggesting annual contribution limits are not necessarily part of the design. Presumably, users of the FHSA could not already be homeowners, but there is no discussion of who is, or is not, a first-time buyer. It’s possible the FHSA could adopt the same flexible definition that applies to the HBP, in which case it would not be restricted to buyers trying to break into the housing market for the first time.

A taxpayer contributing the maximum $40,000 to the FHSA would receive a federal tax subsidy of between $6,000 and $13,200 – depending on their tax bracket. In provinces outside Quebec that adopt the federal tax base, there would an additional provincial tax break of up to $8,000. This is a non-trivial tax incentive, for those under 40 who could manage the maximum contribution. This would be an even more attractive option if there were no annual contribution limits and users already had assets that could be shifted into the new account.

In addition to the HBP in RRSPs, Canada also has a non-refundable tax credit for first-time buyers called the First Time Home Buyers Amount (FTHBA). Introduced in 2009, the FTHBA is worth $750 (or 15 per cent on the flat credit of $5,000) to all first-time buyers. The proposed FHSA would represent a massive additional subsidy for home purchases, especially for high-income Canadians, for whom the tax deduction is worth far more in taxes saved.

Targeted saving programs and tax incentives for homeownership are often inequitable, because high-income families have more funds to save, are more likely to take advantage of the program and are more likely to acquire housing among other assets. This is particularly the case when the incentives rely on deductions, the value of which rises with marginal tax rates. Non-refundable tax credits, by contrast, may not offer much value to taxfilers with low incomes, but the difference in value for middle-income and higher-income taxfilers is generally less than with deductions.

The FTHBA is somewhat less regressive in its distribution as an incentive for home purchase both because it is a non-refundable tax credit and because of the profile of the main users of the tax measure. First-time buyers are generally younger – according to CRA’s final T1 data, in 2017, 68 per cent of claims for the credit were made by taxfilers under age 40. Furthermore, FTHBA claimants also have somewhat lower incomes than the average Canadian RRSP saver, as we illustrate in the figures below.

One way to show inequality in tax measures is with the Lorenz curve, which depicts the cumulative distribution of dollars received for each percentile of the income distribution. If every taxpayer pays or receives the same dollar amount, then the Lorenz curve is a 45-degree line. Curves farther from the 45-degree line represent distributions that are skewed more toward high-income individuals. The above figure shows the Lorenz curve for the FTHBA in 2017, compared to that of RRSP contributions and of taxable incomes. The data are drawn from the Finances of the Nation Income Statistics database.

Note that FTHBA is much less unequally distributed than RRSP contributions, or even taxable income, because more first-time buyers have incomes around the median level (see the second tab in the figure) than RRSP contributors, or taxpayers in general. So, for example, 53 per cent of RRSP contributions came from taxpayers with top 20 per cent incomes, for example, compared to just 32 per cent of FTHBA amounts. That said, most of the FTHBA benefit today still goes to taxpayers with incomes above the median.

Users of the proposed new FHSA would likely have similar incomes as those currently claiming the FTHBA. If so, we can use these data to estimate the distributional impacts of the proposed FHSA. Delivered as a tax deduction, rather than a non-refundable credit, the proposed FHSA would be more unequally distributed than FTHBA, since higher-income taxpayers receive greater tax savings from the deduction and are more likely to be able to make full use of the $40,000 of room in the new account.

But if all FHSA participants do contribute the maximum and there are no annual contribution limits, then using the take-up of the FTHBA as our guide, we estimate that the program could cost about $840 million to the federal government annually, and an additional $520 million in lost revenue to provincial governments, for a total cost around $1.36 billion annually. The cost could be higher if take-up of the new and more generous accounts is stronger than take-up of the existing FTHBA.[1] The average contributor would receive a tax benefit of slightly less than $11,000, while 62 per cent of all benefits would go to the top half of the income distribution. This is a little more progressive than the distribution of tax savings in RRSPs, but still not great.

The obvious question is: Why a deduction? The proposed FHSA would not really be a tax-deferred savings program since the housing asset purchased with the account would never be taxed federally or provincially. This would be a proposed subsidy for first-time buyers. As such, it could be more simply – and far more equitably – delivered as a grant or tax credit than as a tax deduction. Indeed, the Biden administration has proposed a tax credit (not deduction) for first-time buyers, just as Australia has a First Home Owners Grant, which pays the same sum to low-income as to high-income applicants.

Federally funded pilot programs have already looked at options to deliver matching grants into savings accounts for affordable housing, both for ownership and transition to market rental out of homeless shelters. If the policy goal is to encourage young people to gradually build up new financial savings for housing over time, then a progressive matching grant might be a more efficient option than a tax deduction. But at the very least, the proposed accounts need an annual limit on contributions.

Indeed, there seems to be no good policy rationale for the proposed deduction in place of a progressive grant or credit. We’re left wondering why the design of the proposed FHSA is what it is. It’s possible it was largely copied from the 1974 federal budget. But, given the idea that pocketbook issues now dominate election campaigns, it’s also possible that it was deemed more politically attractive to promise a $40,000 deduction than a $10,000 credit.

[1] These calculations are based on the number of taxpayers under age 40 who claimed the FTHBA in 2017, according to statistics released by the Canada Revenue Agency.

Jennifer Robson is an associate professor of political management at Carleton University

Jennifer Robson is an associate professor of political management at Carleton University

Michael Smart is an economics professor at the University of Toronto and co-director of Finances of the Nation.

Michael Smart is an economics professor at the University of Toronto and co-director of Finances of the Nation.