In response to COVID-19, and the public health response to it, Canada’s federal and provincial governments have accumulated debt in amounts not seen since World War 2. General government debt (federal plus provincial) is expected to exceed 100% of GDP — according to the latest forecast from the IMF.

With such large increases, many are concerned about whether these debt levels can be sustained. Timely analysis of public debt sustainability is therefore invaluable. Where are we headed? What risks do governments face? And what options are available? These are big questions, but recent analysis is providing answers.

In a forthcoming paper in the Finances of the Nation series in the Canadian Tax Journal, I lay out a detailed though flexible approach to quantify the scale and scope of our long-run fiscal challenges — both provincial and federal. (A working paper version, subject to revision, is available here.)

This kind of comprehensive examination of provincial governments is necessary. As one of the most decentralized federations in the world, the sustainability of Canada’s public debt depends on the fiscal health of its provinces. Years of steadily rising provincial debt, a severe economic shock from COVID-19, and mounting healthcare costs from aging populations all create pressures.

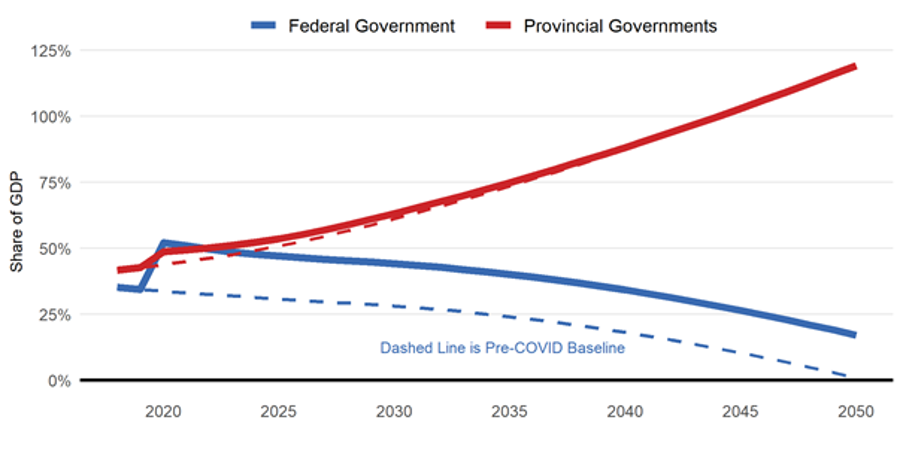

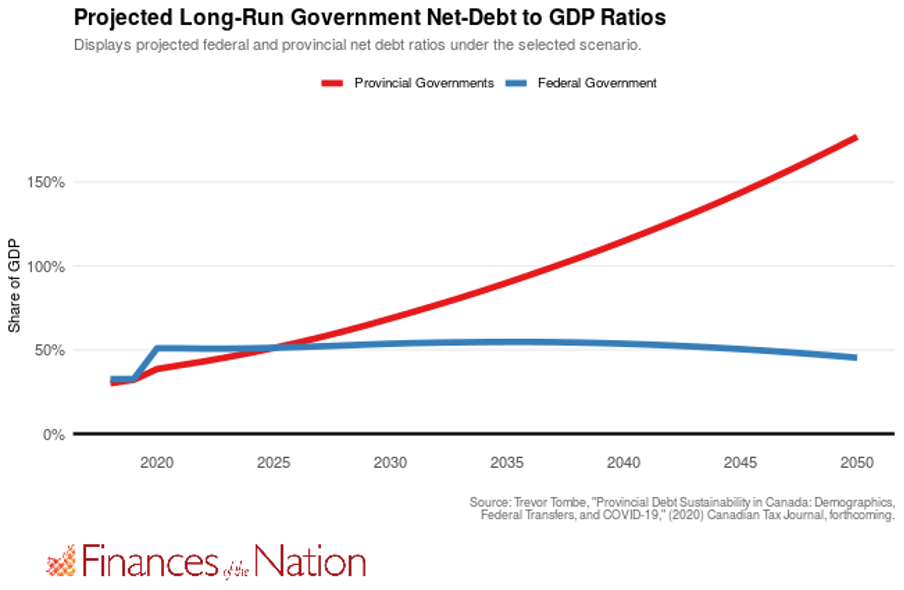

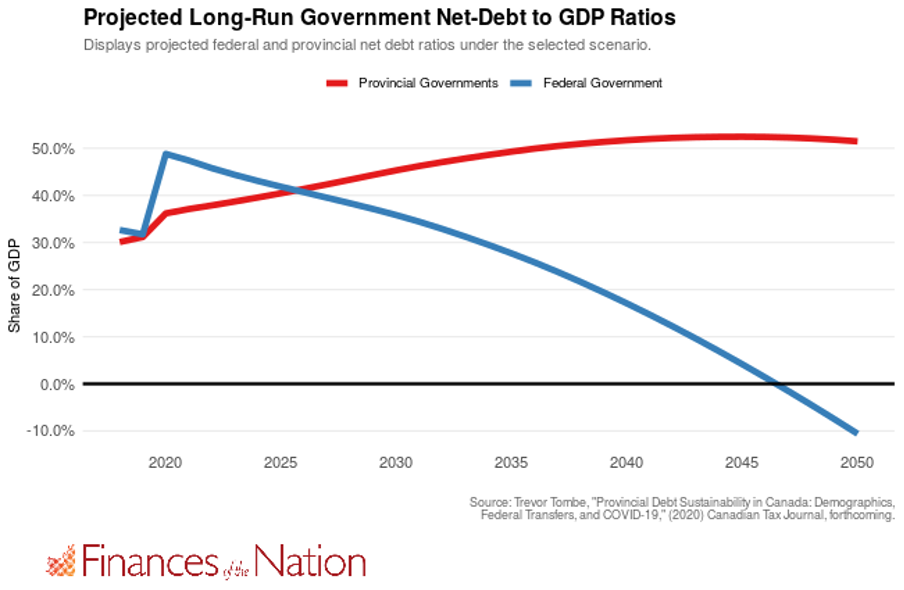

In fact, the long-term effects of the sharp increase in federal debt from COVID-19 is surprisingly small relative to the slower moving but significantly larger challenge faced by provincial governments. In the following figure, I display my main projection of debt to GDP ratios for the federal and provincial governments, pre- and post-COVID. Though not a foregone conclusion, it appears the large federal debt increase this year is dwarfed by what awaits our provincial governments. And the federal government, despite this year’s shock, remains sustainable.

Figure: Post-COVID Debt/GDP Ratios in Canada

Of course, this is just one of many potential fiscal futures. What if interest rates rise? What if economic growth rates fall? What if populations age more quickly (or more slowly) than we currently predict? And what policies might make a material difference to our governments’ long-run fiscal health?

What the future holds, and whether public debt levels are sustainable in the coming years, depends on a variety of underlying factors. A “stress test” of public finances is therefore in order.

A Tool to Stress Test Government Debt

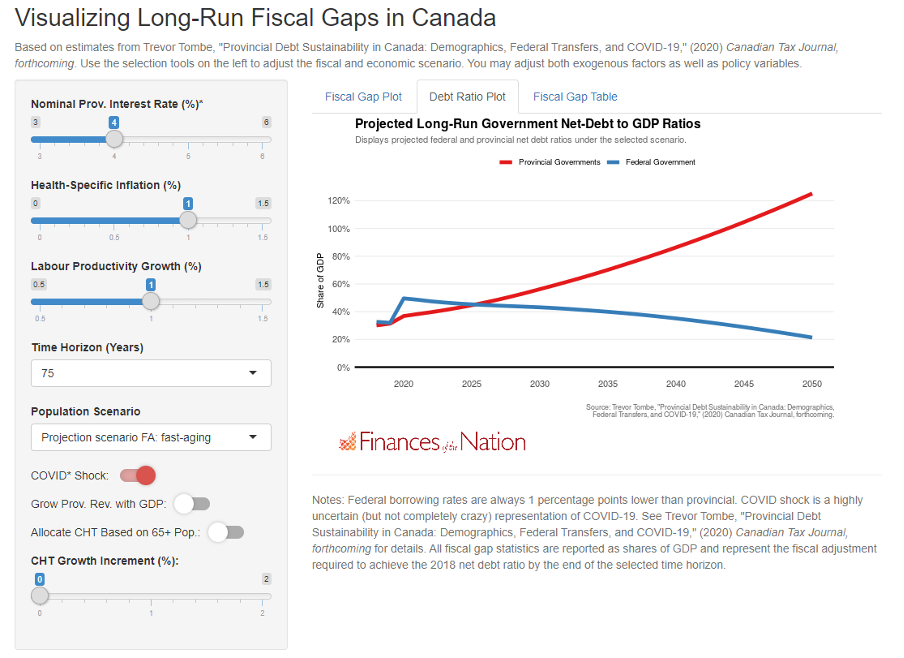

To help make sense of where we may be headed, we at Finances of the Nation have developed an accessible yet powerful new tool to explore what our fiscal future depends on, and what governments should pay careful attention to. Though it is based on the forthcoming Canadian Tax Journal analysis I referenced, it goes far beyond. (Click here!)

You’ll be able to adjust interest rates, productivity growth rates, healthcare cost increases, demographic scenarios, increases in federal transfers, faster growth of provincial revenues, isolate the effect of COVID-19, and more! This tool will be continuously updated and expanded as new fiscal data emerges.

And while it’s only the beginning, it already provides concrete answers to many important questions.

How Big of a Challenge Do Provinces Face?

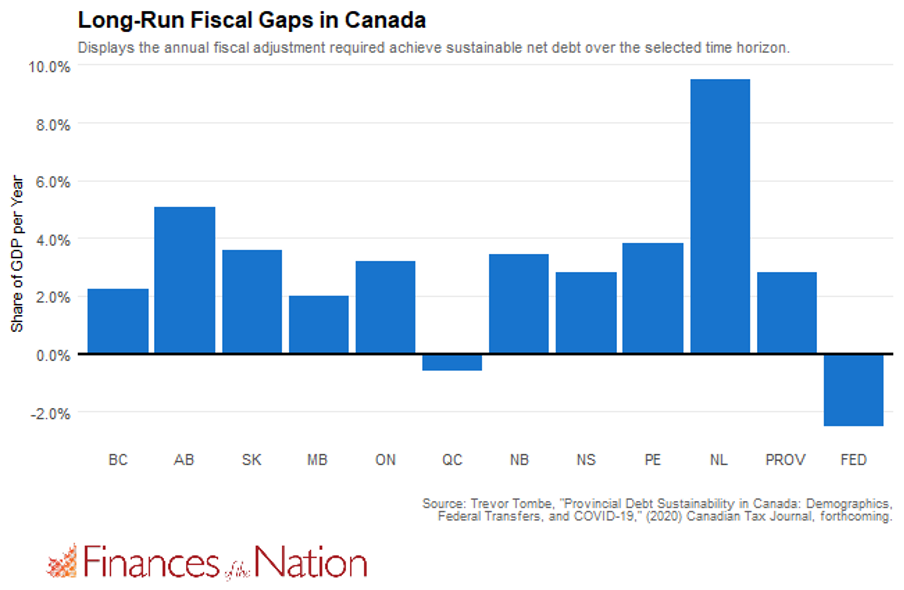

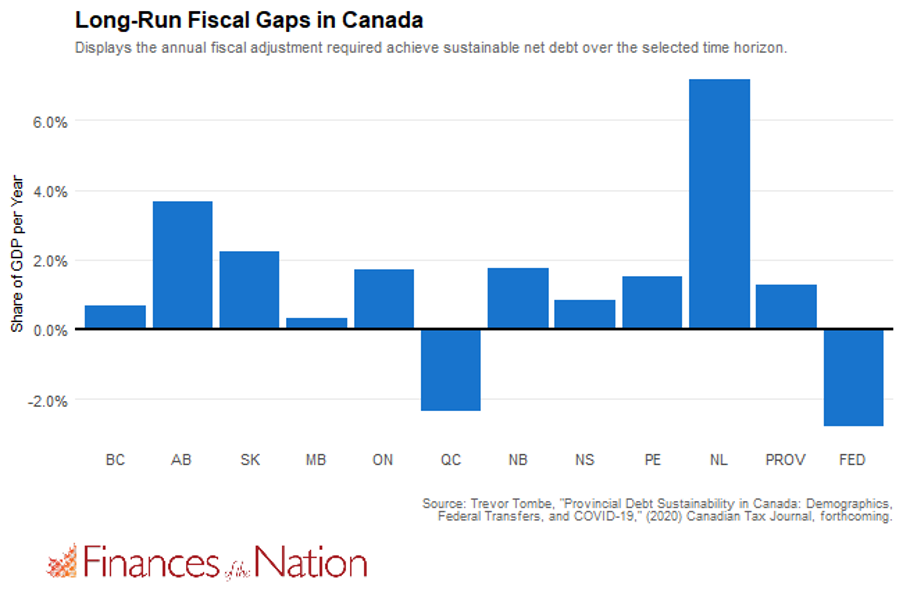

The projected growth in provincial debt is clear, and concerning. One simple measure to quantify the scale of the challenge is called the “fiscal gap”. This represents the immediate and permanent change in revenue or spending that would ensure stable debt-to-GDP ratios over time. Most provinces face a large and positive fiscal gap, meaning sustained increases in revenues or decreases in spending (or some combination of the two) is required. Below I plot the baseline estimate of fiscal gaps across provinces.

These results reveal large fiscal gaps for provinces, averaging 2.8 percent of GDP. For perspective, this is equivalent to roughly an 8% GST. However, not all provinces are in the same boat. Some face truly massive long-run challenges, such as Newfoundland and Labrador with its over 9% of GDP fiscal gap. At the other extreme, Quebec has fully sustainable finances already and enjoys room to slightly increase spending or decrease taxes.

Interestingly, combining both federal and provincial governments together reveals a fully sustainable fiscal future for Canada. In other words, the positive fiscal gap faced cumulatively by the provinces is more than offset by the federal government’s negative fiscal gap. Some will therefore look to changing federal transfers — and the upcoming Council of the Federation meeting will surely focus on just that.

But our fiscal gap analysis tool reveals what the underlying drivers are behind these gaps, and what important pressure points governments — and indeed all Canadians — should be aware of.

Will rising interest rates make current debt levels unsustainable?

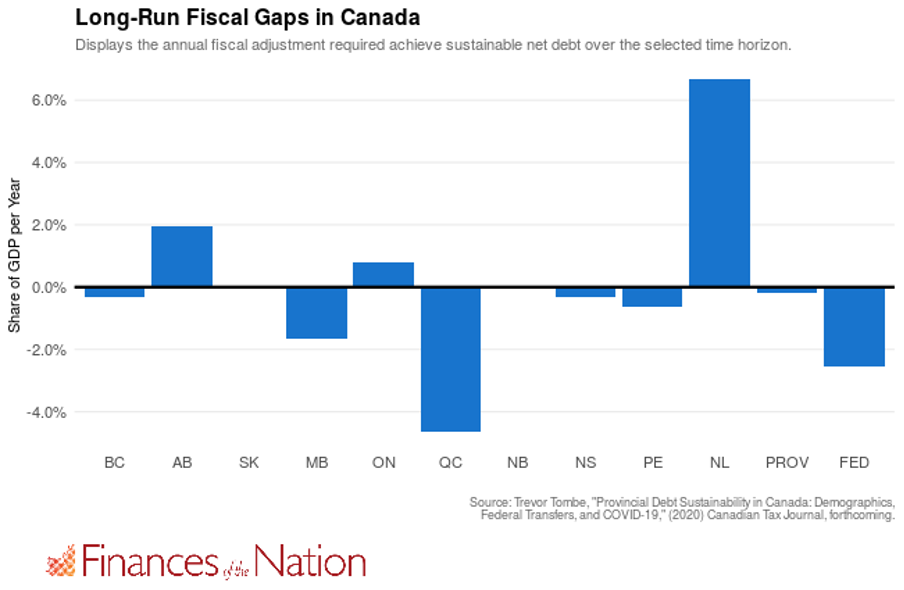

Higher borrowing rates makes debt more costly to carry, and requires governments accumulate larger primary surpluses to offset this. And though today’s borrowing rates are historically low, when today’s bonds mature later they may need to be rolled over at higher rates. How much does this matter for debt sustainability? Setting provincial borrowing rates to 6% and federal borrowing rates to 5% (an increase of two percentage points over my baseline projection), the federal debt post-COVID remains stable as a share of the overall economy, as illustrated below. It eats into the negative federal fiscal gap significantly, to be sure, shrinking it from -2.5 to -1.5.

Future tax and spending decisions of the federal government will certainly change this picture, but increases in future interest rates are not currently the trigger to any federal debt bomb that some fear they are.

Will Faster Productivity Growth Ease Debt Burdens?

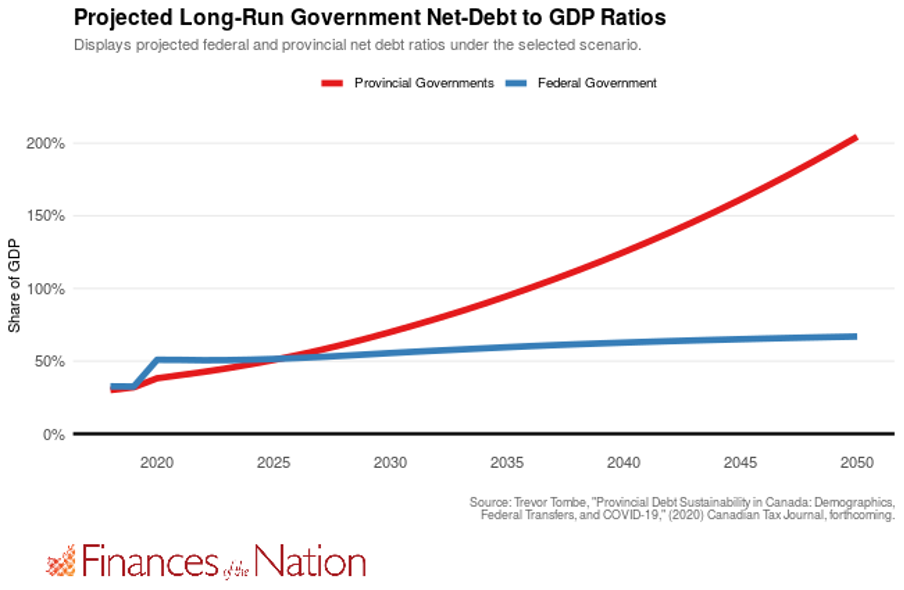

If, in addition to slower health spending, the productivity of Canadian workers grows at 1.5% per year instead of 1% that I presumed initially (which, admittedly, would be a large increase), then provincial and federal finances are both anticipated to be fully sustainable over the long-run. Below I plot the projected debt burdens to 2050 in this case.

What Could Undermine Canada’s Long-Run Sustainability?

The tool also allows you to explore scenarios that represent real risks to long-run sustainability for all governments. If interest rates rise to 5% provincially and 4% federally and if labour productivity growth declines to 0.5% per year, then all governments — including the federal government — see rising debt ratios over time. This wouldn’t be sustainable and would severely limit the scope federal transfer reform to help provincial governments.

How Much Would Slower Health Spending Help?

To be sure, policy choices matter for debt sustainability. On the spending side, the most important driver of long-run challenges will be rising health costs. Healthcare costs tend to increase faster than the economy’s overall rate of inflation, even adjusting for population growth and demographic change. In my baseline projection, I presume health-specific inflation of roughly 1 percentage point higher than the 2% economy-wide inflation rate. If provincial governments can lower this to, say, 0.5 percentage points, however, then nearly 60% of the long-term challenge is eliminated! The fiscal gap declines from 2.8 to 1.2 percent of GDP.

What If Provinces Grow Revenues at a Slightly Faster Pace?

There are also options on the revenue-side of provincial budgets. Provincial income and sales taxes revenues tend to keep pace with the overall economy, but other taxes (cigarette taxes, gasoline taxes, property taxes, investment income, and so on) may not. Overall, I anticipate provincial government revenues will grow slightly less than overall economic growth. But if governments can continuously adjust tax and fee policies to keep revenues growing in line with the economy then then provincial government finances (as a whole) are actually sustainable over the long-run.

Though there are many reasons for concern, there are also many reasons for hope. Provinces have options, and public debt becoming unsustainable even after this massive COVID-19 shock is not a foregone conclusion. Pulling the fiscal fire alarm is premature — thoughtful, gradual, and sustained action by provincial governments can go a long way.

But two provinces stand out as having uniquely challenging circumstances.

Difficult Choices for Some Provinces

Alberta’s persistent fiscal gap, which remains across a broad range of scenarios, is not news for that province. It’s challenging long-run future is well documented. And this province has options to increase taxes and restrain spending growth to overcome its own fiscal gap.

Newfoundland and Labrador, however, may not be able to overcome its challenge alone. This province will see the most rapidly aging population combined with the slowest rate of future economic growth. In some scenarios, its population is actually shrinking, which makes the challenge of sustaining current debt by those who remain more difficult. Changes to federal fiscal arrangements, or other targeted supports, may be needed (and will almost surely be demanded by provincial leaders there).

Stay Tuned for More!

However the future will unfold, this new tool will help us prepare.

It currently allows you to explore over 3,500 scenarios, and more will be added over time! New data will be regularly incorporated into the model, as will new fiscal choices by governments.

As governments grapple with fiscal pressures and difficult choices, access to clear data, transparent analysis, and thoughtful insight will be invaluable. And as debates unfold over important policy options, we’ll strive to shed light on their long-term implications using this tool and delivering those insights through the Finances of the Nation.

So stay tuned for much more from us on these important questions!

Trevor Tombe is Co-Director of Finances of the Nation and an Associate Professor of Economics at the University of Calgary.