Trevor Tombe

The recently approved project could significantly improve Newfoundland and Labrador’s long-run fiscal prospects. Rising offshore production may not only increase offshore royalty revenues but also overall economic activity (and therefore tax revenues). Though many uncertainties remain, it is difficult to overstate the potential fiscal boon Bay du Nord may represent.

Several Canadian provinces rely heavily on oil and gas production to finance public expenditures — none more so than Alberta, and Newfoundland and Labrador.

While this creates challenges for both provinces in terms of significant and unpredictable volatility in revenues, Newfoundland and Labrador confronts a more difficult challenge — the prospect of substantial declines in future offshore oil production, and therefore royalties.

For example, the Canada Energy Regulator’s 2021 report Exploring Canada’s Energy Future projects that production may decline from slightly more than 250,000 barrels per day today to between 150,000 and 200,000 barrels per day by 2030 (depending on the scenario) and to 70,000 to 170,000 by 2040. This would have significant impact on the province’s finances. In 2021-22, the province received approximately $1.1 billion in offshore revenues, which accounted for nearly 19 per cent of its own-source revenues. Falling offshore production would create a large fiscal hole that would be difficult to fill.

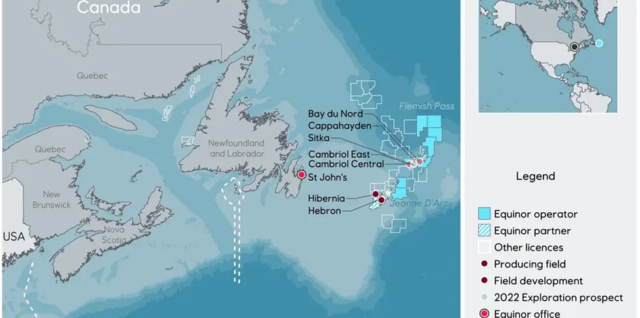

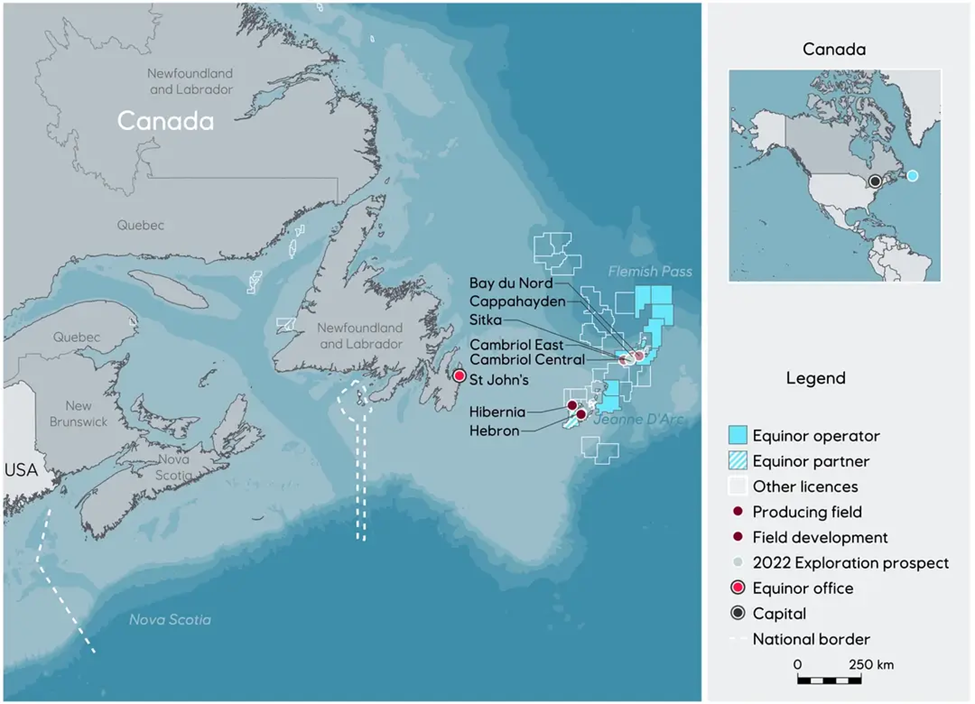

But this challenging fiscal future may soon change with the Bay du Nord offshore project, which recently received final approval from the federal government. A final investment decision has not yet been made by Equinor, the company behind the project. However, if it goes ahead, the project “rewrites the outlook for Newfoundland and Labrador oil production,” Rory Johnston wrote in April in Commodity Context. It’s the first remote, deep-water project in Canada and opens a new basin for future development. When fully operational, it may add 200,000 additional barrels per day in production.

The fiscal implications are equally substantial. The provincial government projects it could receive $3.5 billion in direct revenues and this rises to $10 billion when revenues from corporate income taxes (both provincially and federally) are accounted for. The precise magnitude and timing of such revenues will not be known for some time, but we know enough to get a sense of its importance.

Building on Finances of the Nation’s Debt Sustainability Simulator, which is at its core a set of projection models for provincial and federal finances in Canada, I quantify the potential fiscal benefits of Bay du Nord over the coming decades and project what it might mean for the province’s long-run fiscal sustainability.

To be clear, the effect of this project on provincial government finances is only one of many (many!) aspects of the project to consider. I do not examine the social, environmental and economic implications. But this does not mean they aren’t important — just that I lack the expertise to evaluate them.

To offer another qualification: nothing is set in stone. Projecting oil production and prices is challenging. The Canada Energy Regulator produces long-run forecasts annually under several alternative scenarios. Its baseline projection takes current policies as given and much depends on global climate policy action, which can affect overall demand for oil and gas — and therefore the price of these commodities.

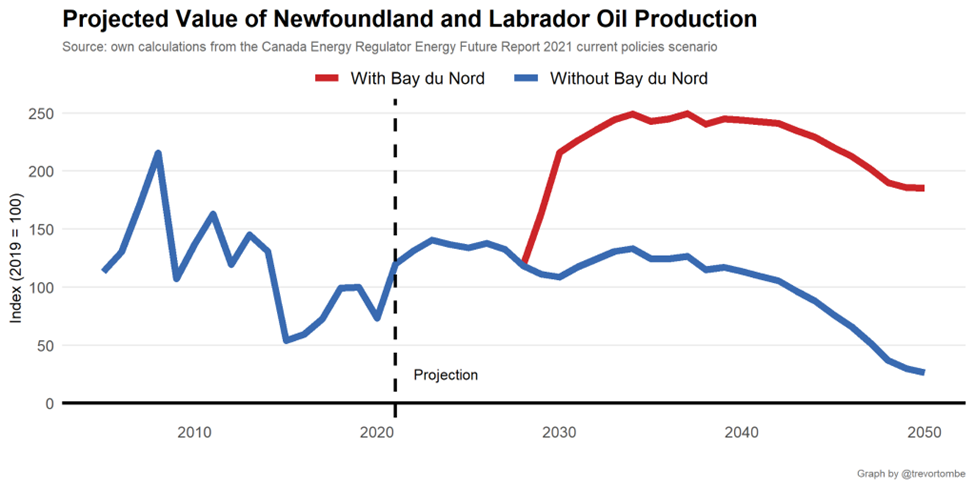

But taking the CER baseline projections as given, and adjusting it to reflect recent increases in oil prices, I find the Bay du Nord project can potentially more than offset the anticipated gradual decline in provincial oil production. I plot this below.

Using this increase in production value — and assuming (simplistically) that government resource revenues evolve roughly proportionally to the value of overall production — I construct a multi-decade projection of Newfoundland and Labrador’s fiscal situation. By the early 2040s, for example, this implies resource revenues may more than double. For perspective, that is roughly $800 million in 2040 alone (in today’s dollars) relative to the baseline projection. That’s roughly one-third of the baseline primary deficit projected for that year. Much depends on oil prices, of course, so we cannot know for sure what revenues will be.

This also ignores both the important spillover effects from increased economic activity (and the resulting income tax revenues) and the effect that increased production may have on the province’s population and demographics. It also does not account for the specific details of the timing of cash flows resulting from this project, any special credits or fiscal supports received by the project, and so on. So, the analysis I present here provides a sense of the fiscal magnitudes involved over a multi-decade horizon and isn’t a precise evaluation of the project. But it is an informative estimate, nonetheless.

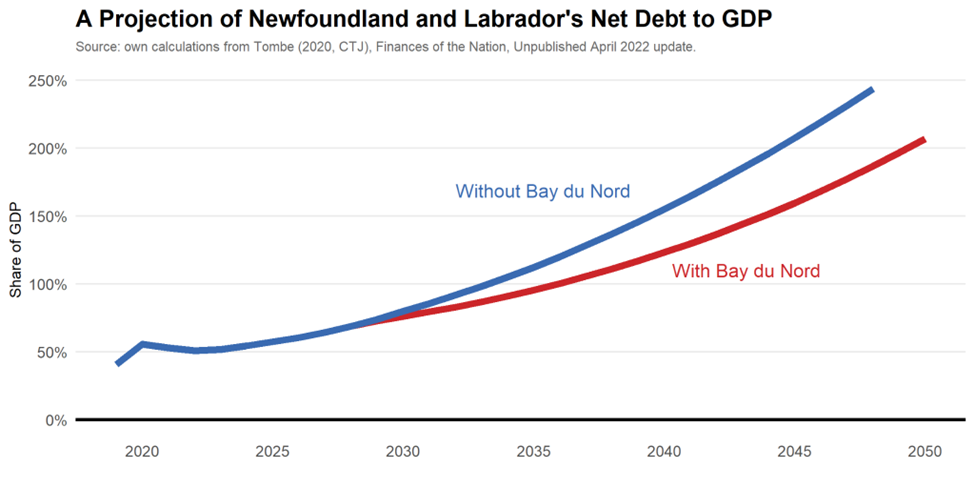

With those caveats in mind, I plot the trajectory of Newfoundland and Labrador’s net public debt as a share of its economy in the chart below, both with and without the new project.

While, like most provinces, provincial debt levels are projected to rise continuously into the long-run future (which is not fiscally sustainable and primarily due to aging populations), the Bay du Nord project may materially improve the future debt outlook for the province.

A more concrete summary estimate is possible and informative.

Sustainable finances generally means that public debt cannot indefinitely increase faster than the overall pace of economic activity. That is, the debt-to-GDP ratio must be stable. A generally accepted measure of the “fiscal gap” between a government’s projected debt trajectory and a hypothetical sustainable one is based on quantifying the necessary increase in revenue or decrease in spending to ensure that over some time period, debt-to-GDP ratios are no higher than today. This is the main statistic reported by the Finances of the Nation Debt Sustainability Simulator.

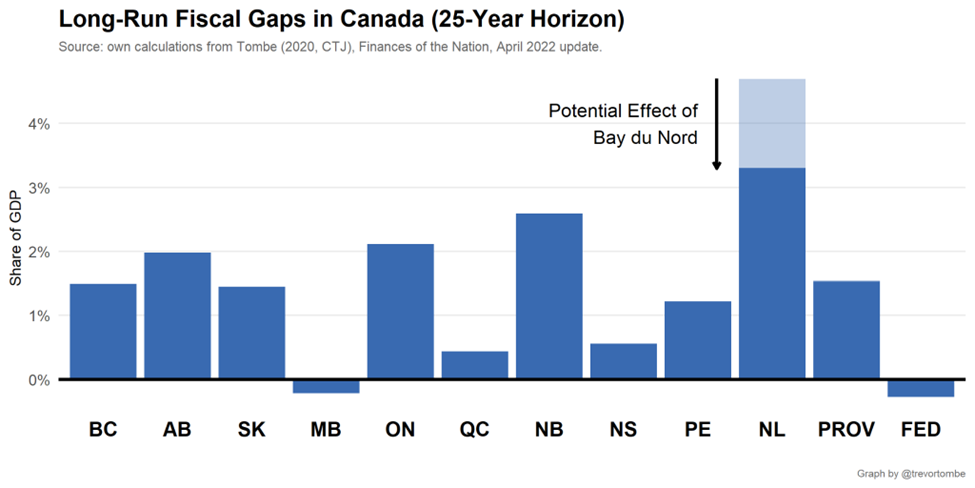

I find Bay du Nord potentially lowers Newfoundland and Labrador’s fiscal gap from 4.7 per cent of GDP to 3.3 per cent. The project’s long-run fiscal benefits are therefore potentially equivalent to an immediate and permanent improvement in its primary budget balance of 1.4 percentage points of GDP. This is large. This closes the gap between Newfoundland and Labrador, and the overall provincial average across Canada, by more than 40 per cent — over a 25-year time horizon.

Importantly, these gains are net of the decreased federal revenues that Newfoundland and Labrador may receive. This simulation finds that the province will no longer qualify for federal equalization payments around 2040, as it would have in the scenario without the Bay du Nord project.

To be absolutely clear, there are still many unknowns and the precise magnitude of these estimates depends on several underlying assumptions. So, this projection should be viewed as nothing more than getting a sense of fiscal scale.

But simply put, it’s difficult to understate the fiscal benefits to the province from expanding offshore oil production. Since Newfoundland and Labrador faces perhaps the largest long-run fiscal challenge in the country, this might be (at least in part) an important factor behind the federal government’s decision to approve the Bay du Nord project.