Michael Smart

Federal emergency wage subsidies are poorly targeted, resulting in a fiscal cost of $25,000 or more for each person-month of employment saved through the program so far. Recent reforms attempt to target subsidies better to reduce fiscal costs, but the new approach creates disincentives for business growth that put the economic recovery at risk. The program should be wound down at the end of the year, and future programs should be designed to direct payments to incremental jobs saved or created by the policy.

September 15 marks the six-month anniversary of the Canada Emergency Wage Subsidy (CEWS), a large part of the federal response to the pandemic lockdowns, and one of the most remarkable public policy experiments in Canadian history. So, how is it going?

CEWS was introduced on March 15 as a 75% subsidy to eligible payroll expenses of Canadian businesses that had experienced a revenue decline of 15% or more. Eligible payroll expense is capped at $1,129 per employee per week, for each four-week period of the program. The threshold revenue decline for eligibility was increased to 30% for April through June (periods 2-4), and further changes to subsidy rates and eligibility rules, described below, were introduced for subsequent periods.

The program has paid out $35.3 billion to more than 300,000 different businesses so far, and the Parliamentary Budget Officer forecasts the total will reach nearly $70 billion by December 2020. CEWS was designed to work together with its sister program, the Canada Emergency Response Benefit (CERB), which makes payments directly to laid-off workers. In contrast, CEWS goes to employers, not individuals experiencing earnings losses. For that reason, it’s worth taking a careful look at the impacts of the program.

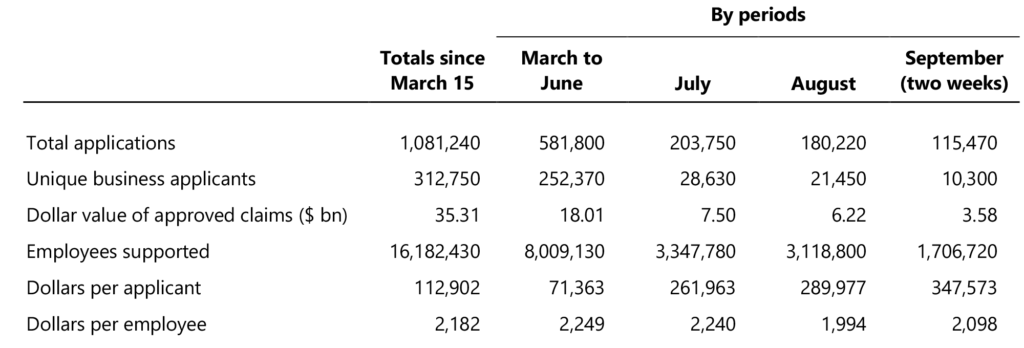

Table 1 shows key statistics on take-up of the program, derived from period reports issued by the Canada Revenue Agency on its website:[1]

- The program cost is holding steady around $7 billion per four-week period, through the end of period 6 at least. The average subsidy for each approved business now stands at about $300,000 per month.

- By August, the number of new approved applicants had fallen to around 20,000. So the program is now mainly serving businesses that are “repeat users” of the subsidy over several months.

The problem of incrementality

By lowering the cost of retaining workers for businesses hit by the lockdowns, the program should help to reduce unemployment and keep incomes flowing. But at what cost? The problem is that CEWS payments are paid for all workers at affected businesses, not just those facing the prospect of earnings losses. That makes the program an expensive way of helping workers hit by the lockdown.

The problem is that most of the jobs funded by the subsidy would still exist in the absence of the subsidy. An effective business subsidy directs funds only to activities that would not happen in the absence of the subsidy — a property known as incrementality. Because new jobs are not being targeted in CEWS, the program has low incrementality.

We don’t yet have reliable evidence on how many jobs would have been lost if CEWS had not been introduced. But preliminary evidence is emerging in the United States for the Paycheck Protection Program (PPP), a large wage subsidy that in many ways parallels CEWS.

According to one recent study, the $517 billion[2] spent by the US government on PPP in its first four months saved only about 2.3 million jobs, at an average subsidy cost of $224,000 per job.

Even by the standards of past job creation programs, that is far from a good deal. The Canadian experience might be different, but we should expect something similar for Canada: too much spent to pad businesses’ bottom lines, and very few jobs saved relative to the amount of money spent. In fact, because it rewards companies that rehire all their workers, the US program probably has better incrementality than the Canadian one.

This should not be a surprise. Past economic research tells us that employment is not very responsive to wage costs in the short run. Although we do not yet have direct evidence on the impact of CEWS in Canada, using a typical estimate of the elasticity of demand for labour for Canada, we would predict[3] that each job saved through CEWS has cost Ottawa about $25,000 in subsidies per month. (This number is roughly 12 times the cost per employee reported in table 1, because only about 1 in 12 employees owes the existence of their job to CEWS.)

My estimate is smaller than the cost that the US study found, but it is still a high price to pay.

Other countries have also experimented with new job retention schemes during the pandemic, whether through wage subsidies as in Canada and the United States, or through “job sharing” schemes as in some European countries. Those countries are also now recognizing that, to be effective, business support needs to be targeted to ensure incrementality, and government should focus on workers facing job loss, not on employers.

Of course, CEWS could also be serving other objectives, such as providing liquidity to businesses. But, in this respect too, CEWS does not effectively target those most in need. It’s also true that, by saving some jobs, CEWS reduces the costs of CERB and Employment Insurance benefits. But those considerations don’t change the basic conclusion: CEWS is too poorly designed to save jobs in a cost-effective way.

The September reforms

On July 17, Ottawa announced changes to CEWS that will make subsidies available to more employers, but at a subsidy rate for most that gradually declines over time. These changes will come into full effect only with the September reporting period, and it is worthwhile to speculate now on their likely effects.

The lower subsidy rate (as well as the greater complexity of the new program) is alarming some observers. A recent newspaper article, citing anecdotal evidence, reports that the September changes are “prompting even more companies to abandon” CEWS. A closer look at the reforms leads to different conclusions, however.

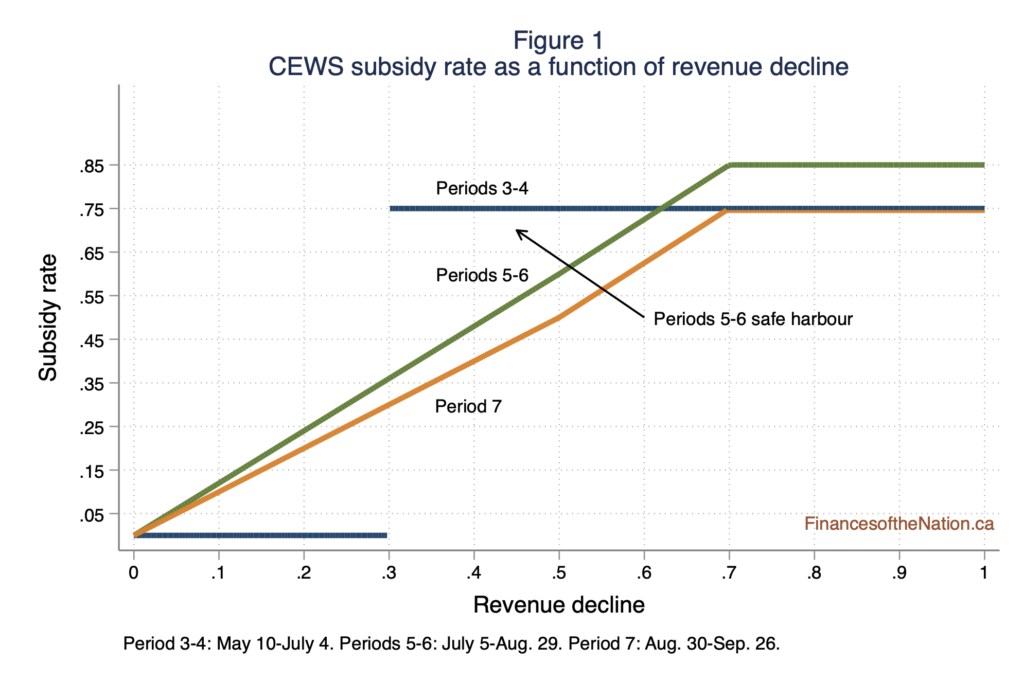

Figure 1 shows CEWS subsidy rates as a function of each applicant’s revenue decline for reporting periods from May through September (periods 3-7). Beginning in July (period 5), the 30 percent revenue decline threshold has been abolished. All businesses became eligible for a wage subsidy equal to 1.2 times their revenue decline rate, and “top-up” subsidies became available for firms experiencing declines of 50 percent or more.[4]

For businesses with revenue declines between 30 and 62 percent, the new treatment results in a lower subsidy rate than before. But a transitional “safe harbour” rule let these applicants claim the previous 75 percent subsidy rate for the July and August reporting periods as well. The safe harbour provision expired on August 30, at the beginning of period 7.

Because employers apply retrospectively for the subsidies after the end of each period, it is too soon to know what impact the changes are having. We simply have no data. As noted above, there has been a gradual decline in CEWS take-up in past months, but this likely reflects the decline in eligibility as many businesses’ revenues recover from the lockdown. In this sense, the decline in CEWS payments is actually a good-news story.

That said, with the lower subsidy rates now available to many applicants, an increase in layoffs and a decrease in CEWS spending are likely to occur in the coming months. On the basis of the available evidence, the employment effect will be small. Moreover, as CEWS costs come down, Ottawa will have more fiscal room to assist displaced workers in other ways.

But the September reforms create a new class of problems for CEWS. Employers’ wage subsidy rates now automatically fall as business revenues recover toward their pre-pandemic levels. This “clawback” of subsidies from growing businesses has exactly the same effect as a tax on gross revenues. It creates a disincentive to grow business operations during the recovery, and it could force businesses to increase retail prices to cover costs.

And the tax effect is substantial. For a typical retail business, payroll costs are 40 percent of gross revenues on average. Under the CEWS clawback rules for period 7, that means a $1,000 increase in revenues will result in a $480 reduction in CEWS payments. That’s a 48 percent marginal tax rate on revenues that struggling businesses must pay, in addition to their normal business taxes.

Of course, a 48 percent gross revenue tax is bad policy, whether in good times or in the course of a fragile economic recovery. But Ottawa has slipped one into its wage subsidy program, apparently without much discussion.

The way forward

CEWS is an expensive and ineffective policy for dealing with labour market slack, because it was not targeted to the jobs that were most at risk during the lockdown. A conservative back-of-the-envelope calculation tells us that CEWS has been paying businesses $25,000 per month for each job saved by the program. There are far better ways to assist the recovery.

Ottawa’s attempt to better target CEWS through the July reforms was ham-fisted at best. The cost of the program will decline, which is a welcome change. But assisted businesses will now see CEWS payments decline sharply as sales expand, creating a significant impediment to recovery.

Ottawa has announced CEWS program parameters through December 2020. The program should not be renewed after that date. If further experiments with wage subsidies are attempted in the future, they must be designed to ensure the incrementality of jobs that are funded. That could be achieved by making subsidies a function of changes in employment or payroll costs, not just gross revenues. Full subsidy payments should only be available to businesses that rehire all workers who were laid off during the pandemic. That requirement is part of business assistance programs in other countries, and it is time Ottawa tried it as well.

Michael Smart is professor of economics at the University of Toronto, and co-director of the Finances of the Nation project.

[1] To measure flows over time, I recorded data from CRA’s program summary data as of July 6, August 2, August 30, and September 13. These dates correspond closely to the ends of the four-week periods over which subsidies are paid (except September 13, the most recent data available). For simplicity, I refer to these periods in the table by the names of calendar months.

[2] Yes, billion with a “b”!

[3] Using the standard formula for excess burden of a subsidy, net government expenditure is approximately

G = swL + (sw − b) ΔL

where s is the subsidy rate, b is the unemployment benefit, w is the average wage, L is the number of assisted workers, and ΔL the number of jobs saved by the subsidy. The first term in the expression is the direct fiscal cost of the subsidy, and the second term is the “fiscal externality”: the impact of increased employment on CEWS subsidies, net of the CERB benefits saved by reducing unemployment. Using the approximation ΔL = εL log(1 − s) and assuming an elasticity of labour demand of ε = −0.15, I estimate that CEWS increases employment in the affected firms by about ΔL = 9 percent. Since the average CEWS benefit was about $2,250 per four-week period, and the CERB benefit $2,000, the net fiscal cost of the program is therefore G = $2,272 for the average worker assisted by CEWS. Dividing G by ΔL gives the estimate of about $25,000 per job-month saved through the program.

[4] The top-up subsidy rates are based on average revenue declines in the prior three months, not just the current month. The rates shown in the figure assume that the revenue decline is constant over time.